On Weekly and Daily charts I see clear break of range for Nifty and a directional move to test 11,000 + looks to be on cards.

This week, we explore Three most interesting multibagger ideas. Please treat this only from training perspective to learn how to evaluate stocks rather than blindly following.

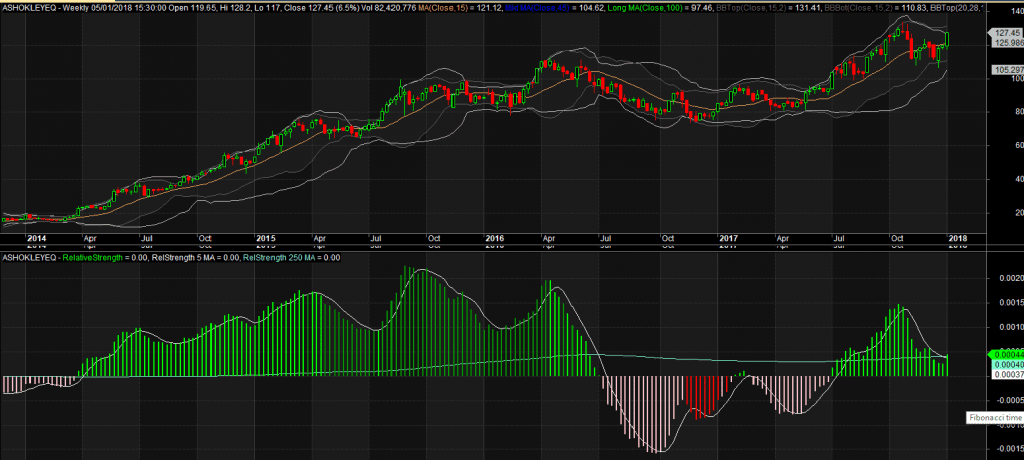

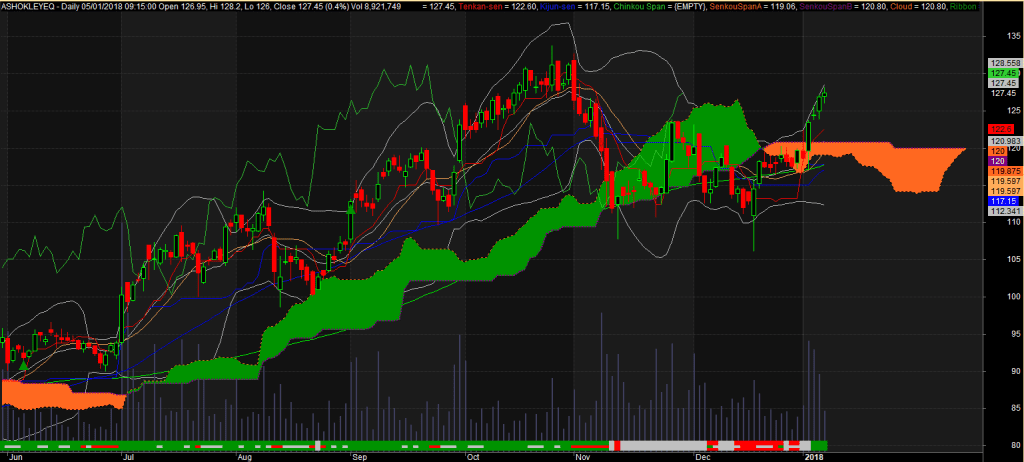

Ashok Leyland is my pick from Auto sector – this is giving a very nice breakout of bollinger band with our relative strength trying to breakout. n daily charts it also had a very nice cloud breakout with future cloud about to tern green…. Definitely worth watching

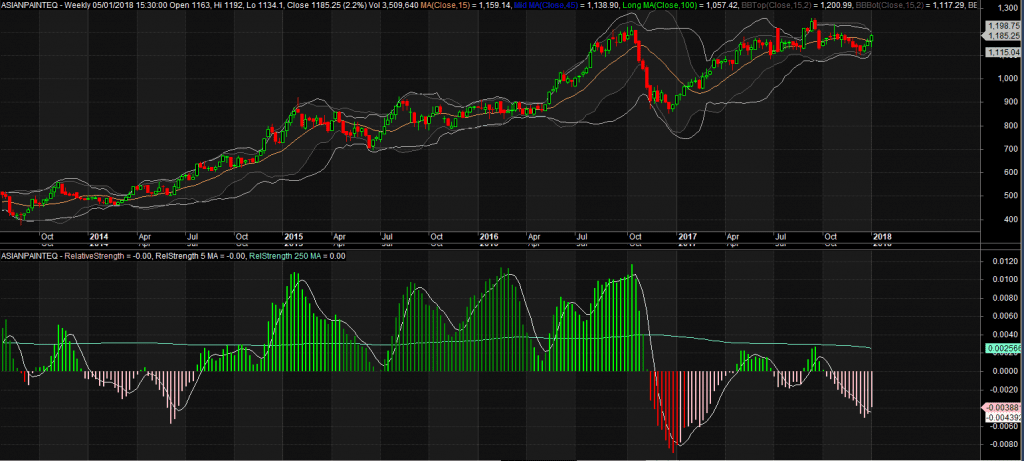

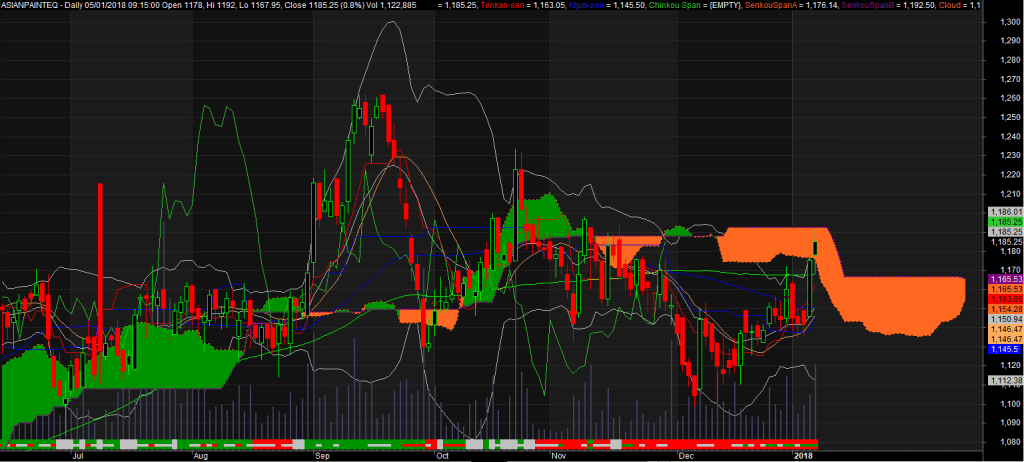

Asian Paint –

Asian Paint is another stock which does outperform Nifty most of the time. On weekly charts yet again it seem to have started outperforming. Plus shows possibility of breaking daily cloud. This should be bought only after successful breaking of cloud. Also keep in mind that this stock is dependent on Crude oil prices. So if you think now crude is going to stabilize for few weeks, this stock is worth investing into.

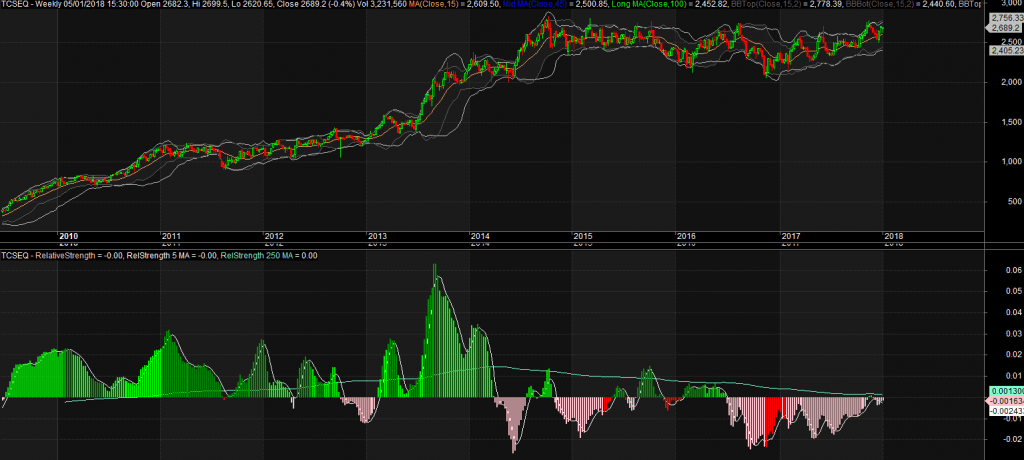

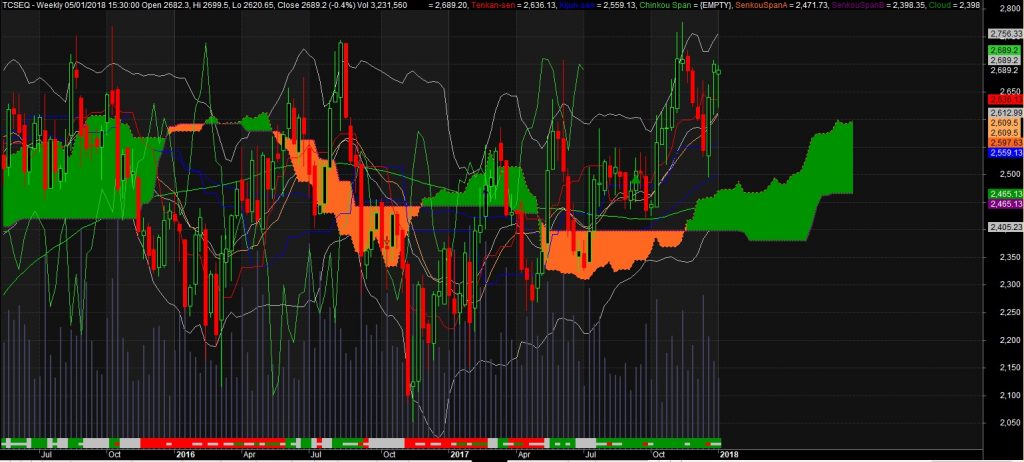

TCS

TCS is my favorite for last few weeks already. This is going to do what Reliance did in 2017. This stock is in consolidation for more than 3 years now. It has taken nice support of Monthly cloud, Weekly cloud is now getting to be consistent green indicating that the consolidation is getting over.