What is possibility of 12 Aug 2020 being an intermediate top?

On 11 Aug, we tweeted – https://twitter.com/MilindAPol/status/1293202204115890177?s=20 as 12 Aug was a very important Gann date, plus its 12 years from 12 Aug 2008 which was an intermediate top after which markets corrected 51.6%.

To review the same in video format –

Gann Time Cycles

The Natural Cause of the 20-Year Cycle

This natural cause is the conjunction of the planets Jupiter and Saturn. A planetary conjunction occurs when the difference in longitude between to planets is zero degrees. If you were looking up into the night sky, the Earth, Jupiter, and Saturn would appear to be in a straight line. The actual amount of time between the conjunction of Jupiter and Saturn varies from slightly under 20 years to slightly over 20 years.

Another important cycle Gann followed was 12 year cycle, time Jupiter takes to orbit Sun.

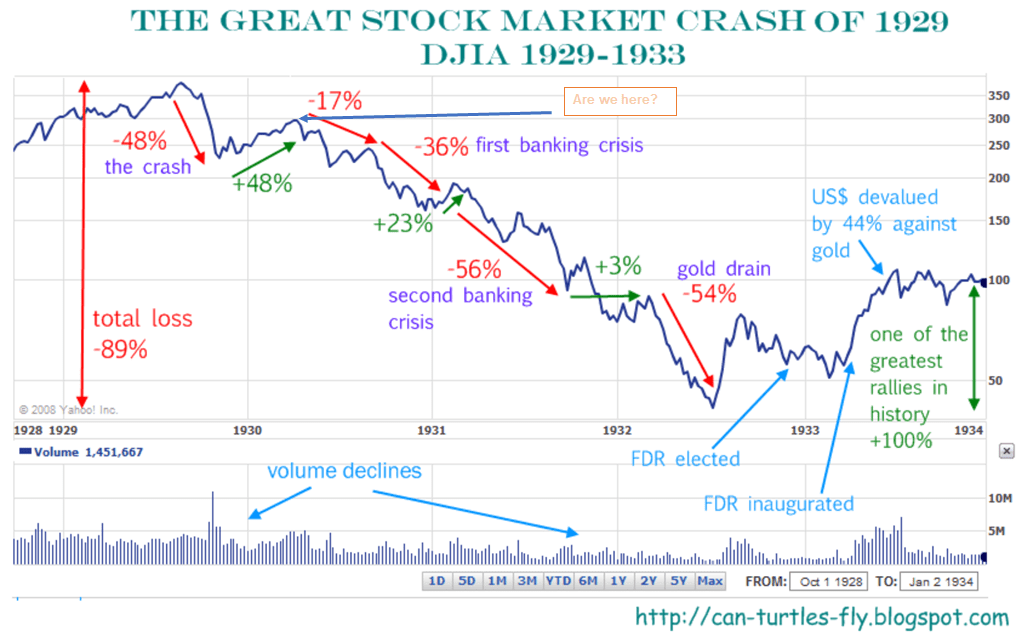

And then we have a great cycle of 90 years.

90-Year Cycle: “When we start from Sunrise or the Horizon and measure to Noon, we get an arc of 90 degrees, which is straight up and down starting from the bottom. 90 months or 90 years is a very important time period. The 90-Year Time Cycle is one of the very important ones because it is two times 45 (“The digits 1 to 9 when added together total 45. 45 is the most important angle.). This time period must always be watched at the end of long time periods

Year 2020 is 90 years from 1929-32 fall, 20 years from 2000-2001 fall and 12 years from 2008 fall.

Comparison with 90 Year cycle

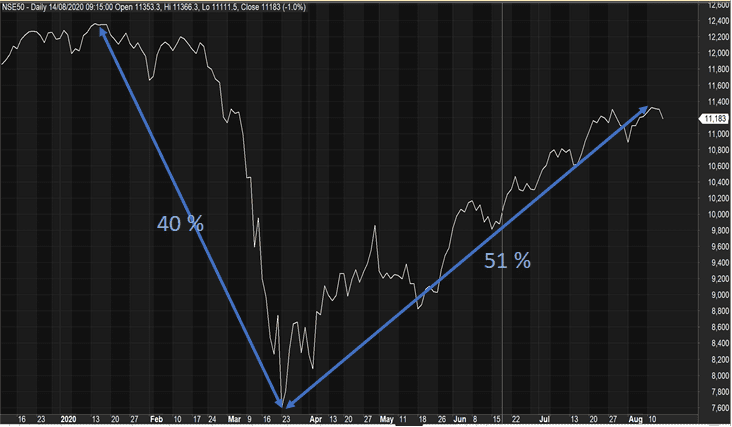

We have done -40% and then +51%

Lets go back to our Original Question – What are chances that we top out on Gann Date of 12 Aug 2020?

Rest of this blog is to analyse if this date could mark turn in direction.

Here is the question –

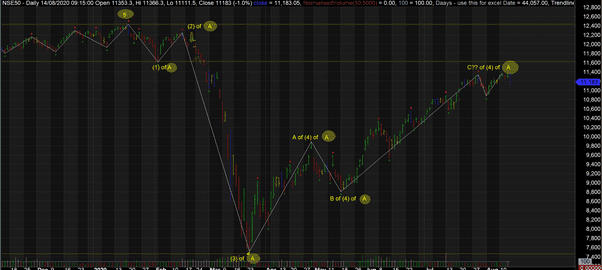

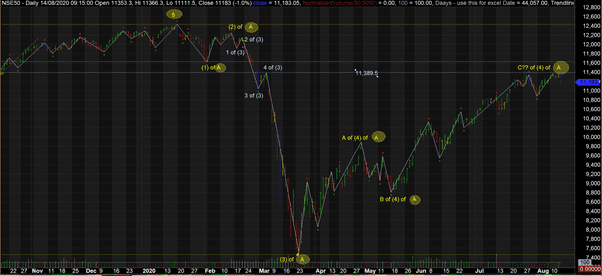

Can we call the high on 11 Aug to be wave C of (4) and start a wave (5).

Lets evaluate using Elliott waves –

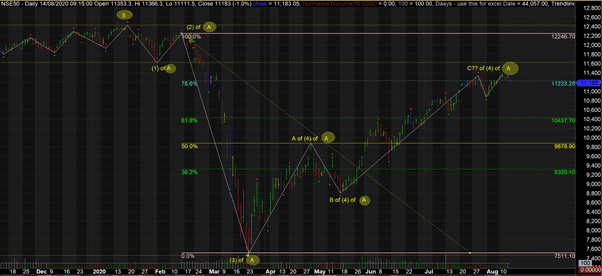

Rule 1 – (4) usually ends at Fibonacci level of 50% or 61.8%

Nifty 50 has crossed 78.6% of 11,233. However, it has started seeing some resistance around these levels. But this rule is not true at this point in time.

Rule 2 – (4) usually ends at 4 of (3) (previous down move)

This was printed at 11,389.5 on 5th march and 11 Aug high is at 11,373.5. This rule seems to be a plus.

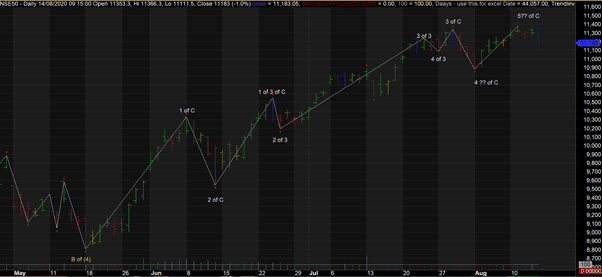

Rule 3 – Internal structure relation with Wave A and Wave C

This is the closest Elliot wave counting I can do at this point in time. (This may not be accurate count and we may be going through a complex correction, in that case, whole of counting needs to be revisited). Assuming that we are right in our wave count. There is a possibility (not very confident as 4 of C may be still not over and one more wave 5 of C may be pending.

So this is possibly a neutral to slightly positive.

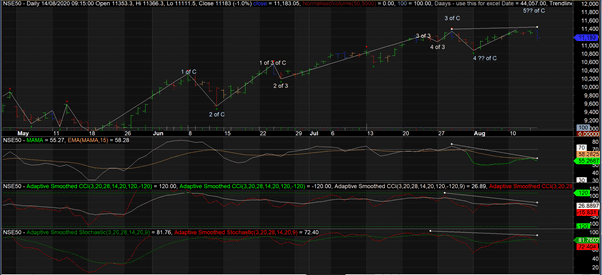

For those watching Divergence –

You will find divergence in most of the oscillators.

Final take –

As per Gann cycles, we are expecting a larger and longer correction. Elliot also suggests a longer correction.

Per Gann analysis 12 Aug is a very important date for intermediate top and we have also seen a start of fall on Friday 14th, Elliott still not showing enough supporting evidence that we have marked a top.

In such cases, its advisable to wait for a clear confirmation – may be a lower low and lower high before taking large bets. And to have tight stops for your shorts if already created….

I shall write next blog when I see a clear reversal.