This Interview can be found at https://www.moneycontrol.com/news/business/markets/guruspeak-milind-pol-a-versatile-part-time-algo-trader-6125651.html

I am reproducing it here…

The best guide by far has been the market itself. Markets make you humble.

In legendary trader Victor Sperandeo’s words, trading success is all about emotional discipline, if intelligence were the key, there would be a lot more people making money trading. Milind Pol learnt this the hard way.

A Mechanical Engineer from IIT Mumbai, it took him 13 years to find the right answers. It was not that he did not have the right strategy, his problem was he had too many right strategies and was jumping from one strategy to another. As is the case with most traders, Milind Pol learnt his lesson after a big loss. He borrowed money to recover from the loss and has never looked back since.

Working as a CTO in a healthcare IT firm outside India, Milind Pol uses algorithm trading to trade Indian markets. A blogger and a YouTuber, he has started a new initiative called Dare2Dream where he interviews people walking the unconventional path in chasing their dream.

In this interview with Moneycontrol, Milind Pol talks about his trading journey, strategies and his goals.

Q: A brief background and your introduction to the market

A: I am a Mechanical Engineer from IIT Mumbai and have worked with Infosys for about 10 years. Presently I am working as a CTO (Chief Technology Officer) in a healthcare IT firm.

My introduction to the market was after meeting my father’s friend who back in 1993 approached me to help him with a charting software development. This was at a time when I was still studying in IIT and was apprehensive of the markets. I really never thought that in a few decades, I will start loving charts and technical analysis. But my first brush with the market was when I was in Infosys and had received shares under the employee stock ownership plan (ESOP).

This was in 2000 and I watched my holding value was always positive back then. However, markets to me were always a mystery and I wanted to explore it. I dug deep and learnt about economic cycles, central banking fundamentals, various industry evaluation methodologies and finally Technical Analysis. A new horizon opened up when I learnt about possibilities of options trading and combining it with technical analysis.

In 2005 I started options trading but could only breakeven for almost 5 years. It was not because I was not good enough, but because I was constantly learning and trying different things all the time.

Q: How did you find your mojo?

A: I have been fortunate to have a lot of teachers and guides in my journey as a trader. It all started with some training audios from Optionetics and reading books on technical analysis from authors like Mark Douglas, Dr Alexander Elder and many more. It was the book Mind over Markets that changed my view towards completely.

I am also thankful to several Indian trainers and guides, worth mentioning among them are Santosh Pasi – for converting all my Options knowledge into clear tradable Options strategies with the most important fact of managing my positions well. Then there is Rajendran of Marketcalls on Market Profile and Amibroker, Avadhut Sathe on learning basics of technical analysis.

But the best guide by far has been the market itself. Markets make you humble. Only when I figured out my real reason to be in markets, I reached a milestone worth mentioning. The learning was that the most important thing that matters is – if you are making money, nothing else matters.

You may be an excellent analyst, you may know everything about options, you may have all the risk management knowledge but if you are not making consistent profits from the markets, you are wasting your time.

Q: How did you trade in your initial years?

A: For the first five years, if I take out the gains from my ESOP holding of Infosys, my performance was neutral. Then I started using a very expensive market trading product called Advanced GET from eSignal and made decent money trading on it. But the money was not enough to cover the cost of the software. So I shifted to Amibroker for charting.

I used to wake up at 4 a.m. and study charts till 7 a.m. before getting ready for my day job. Back then I was studying more than 200 charts daily, which has helped me the most in my growth as a trader.

I was all over the place for the first few years. I did not know the importance of keeping a journal or having a trading plan. My trades lacked consistency in plan, money and risk management. On some trades, I would risk with a few thousand while on others I would risk a few lakhs. It was only after I met with the mentors I talked above I appreciated the structured approach to trading.

Q: What was the most difficult aspect of trading that took time to master – one which was the defining moment.

A: For me, the most difficult aspect was emotional control, that I call Effective Mind Management. I have, like many traders, a gambler’s attitude. Even if my charts say one story, I trade either to take revenge or to just prove that I am right or simply on gut feel.

It took me more than 12-13 years to get over this problem. In 2015 I lost nearly one-third of my net worth, shattering my early retirement plans by a few years.

I was doing extremely well before that by selling options strategies and wanted to increase my returns from 5% to 7% a month. That one mistake taught me more than the last 13 years of learning.

I had gone through emotional, financial stress which could have been avoided if I would have been a little cautious. I spent a month analysing my mistakes and decided to follow the following rules no matter what –

a. Journal should be analysed for Return over Risk

b. Never risk anything which will make you lose your sleep

c. Compare your performance to Nifty performance and not to any other trader. We all have different methods and skills.

After the major loss in 2015, I took a loan of double my loss value. I used one portion of it to pay off the loss and the remaining half I invested in stocks. I used these stocks as a margin and deployed it on strategies based on Santosh Pasi’s options strategies. In less than 5 years, I have recovered all my losses, paid back all the loans and have also bought a new house.

Q: How do you presently trade?

A: I adopt multiple trading strategies and styles.

Elliott Wave

I am a long term Investor, I predominantly use Elliott (Wavy Tunnel) and Gann along with my self-developed indicator based on Relative strength (against Nifty).

I start with analysing Nifty and based on Elliott counts I have a view of its movement for the future. That view gets confirmed with time-based expectations using Gann time cycles and other Gann methods.

After I get my view on Nifty, I choose stocks using my relative strength methodology.

When I believe Nifty may fall, I would buy far, very far Options. For example, I currently hold 2021 December Nifty options. These are more of a hedge.

My hedges themselves have worked out well and have done more than 2.7 times to Nifty returns in the last 3-4 years till its fall in January 2020, clocking a compounded return of 26 percent. I was also able to make a decent profit during the subsequent fall on my Put purchases.

Equity Buy example

First Plot Nifty Elliott waves

This is a chart of Nifty in March 2016 where we can see that (3) is retraced by a little more than 50%. The Awesome oscillator has printed a higher peak and most of the oscillators – RSI, Stochastics, etc are in oversold mode. On the weekly charts (below), you will also be able to plot A-B-C correction over with C = 1.27 times A.

Trigger for a long entry was to either use your oscillators or break of Regression trend on B-C impulse.

Choosing the right stocks

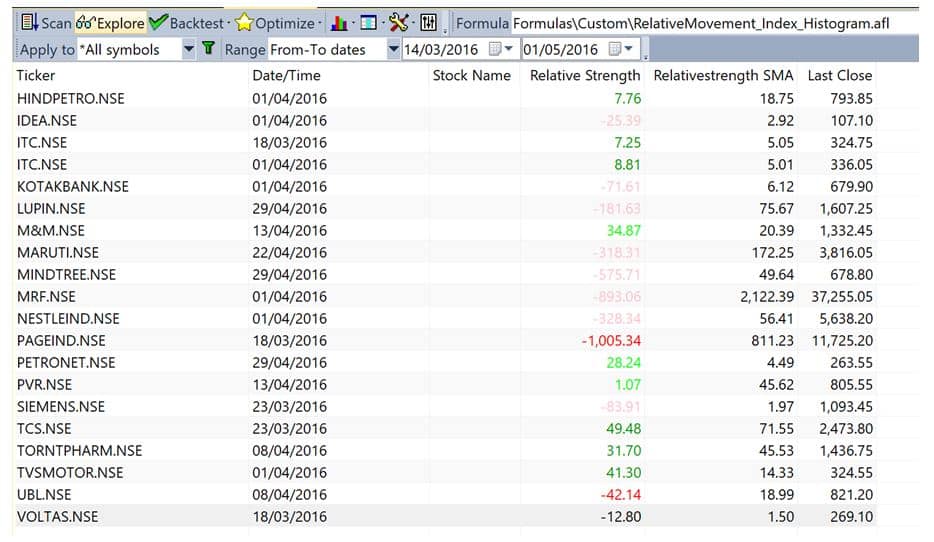

On this day I run my Relative strength scanner – which looks at stocks which that have shown strong positive momentum compared to Nifty over 200 weeks but in the last 5-8 weeks, they have poor strength. I look for those stocks that have started moving up again.

I would buy any of those stocks after analysing their chart patterns further. I would have a high of Wave (1) as a stop loss on Nifty.

Some of the stocks identified using this method with entry and exit price.

Maruti – 3300 to 9700

HindPetro – 760 – 1250

Kotak Bank 650 – 1700

Nestle 5,350 – 16,000

TCS – 2200 – 3550

Voltas 270 – 700

Petronet 240 – 440

Automated trades

This is a relatively new way of trading. I have been able to turn all my knowledge into a well defined automated algorithm which trades Bank Nifty options.

I use Ichimoku clouds, Bollinger Bands and a few concepts from my relative strength trading indicator to choose the right option to trade. A typical trade runs for anything from 2-3 days to 2-3 weeks.

I did forward testing of the strategy in 2017 which proved that you can double your capital almost every year or less. However, I could not run the algo then for lack of reliable automation tools. Now that the technologies are much more sophisticated, I am working on building a fully automated trading set up.

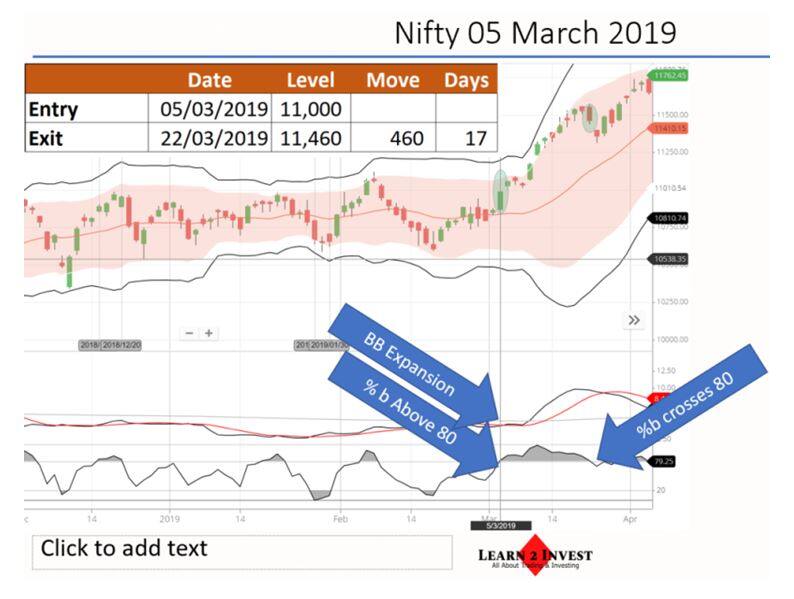

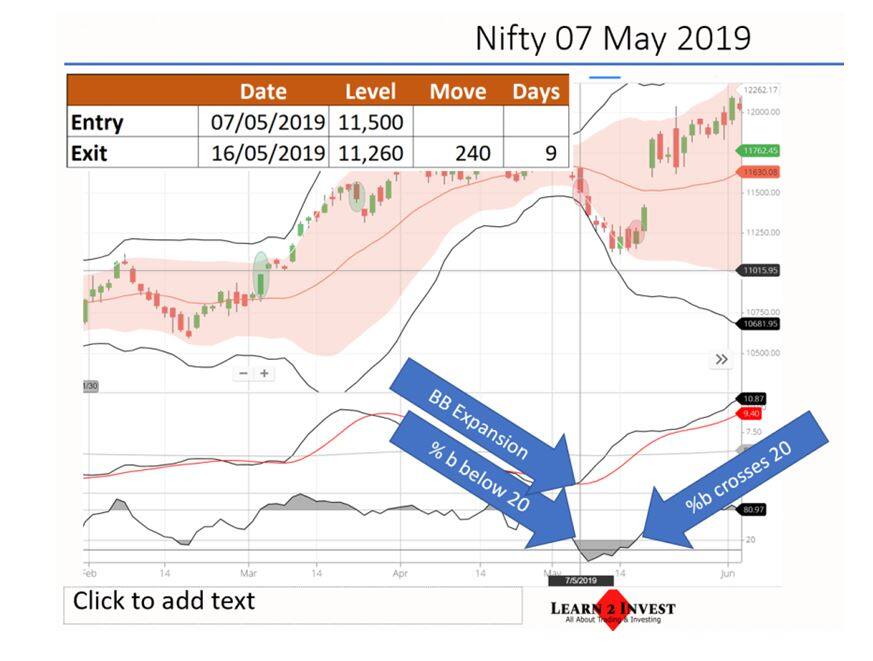

Bollinger Band Algo trade

Bollinger Band Setup

Option buy

Squeeze Bandwidth below 200 EMA

When BB is expanding (Bandwidth Cross above 8 MA of Bandwidth)

Decision of Direction

%b > 80 – Long,

%b < 20 – Short

•Exit

Long – %b < 80 – Long,

Short – %b < 20 – Short

•Timeframe to trade –

Daily if swing trading for 3-20 days

Weekly to trade with monthly options 3-20 weeks

Examples

Options Strategies

I also trade based on options strategies which are now traded based on automated algo. This strategy provides me with passive income.

Algo converts the signal into ATM Option buy. Entry and Exit are on the underline. But there is also a stop loss on point basis on Option price levels. The same set up also works very well on intraday charts.

Q: Your plans for the future

A: I have learnt a lot from markets and I am a continuous learner. I keep on learning and experimenting with new things all the time. My biggest vision is to help aspiring traders.

I have also started a new initiative recently called Dare2Dream which is to help connect with people who have chased their dream. People who have pursued hobbies like dancing, singing, farming or taken risks to start a business based on their dreams. We get to hear success stories of people who have made it big, smaller success is never talked about. This initiative is to step back and see the huge distance these dreamers have covered. One can relate to their success, rather than relate it to a Ratan Tata or Dhirubhai Ambani. These people may not be super successful, but definitely on the right path and their stories are truly inspiring. This initiative is also to motivate and inspire those who are sitting on the fence, have a lot of dreams but for some reason or other are not able to take the leap of faith.