This week we evaluate how you could have a directional trade position which you will manage effectively to make sure that you dont loose a single penny. While this article is written for Indian index Nifty, it is equally applicable to any other market. In US, it works better as you have huge liquidity for far positions…

Beauty of Options

- You have unlimited opportunities to place your trades

- You can modify your positions during to change your position

- You can reduce your risks or even play zero risk game

- You may go completely wrong with direction expectation, yet make profit

- You can convert small risk to reward to high risk to reward

- You can outsmart your opposition

All you need is – A well researched strategy and plan That Works!!!

This article is about one such directional strategy, That works in current low Volatility With very good outcome

Background

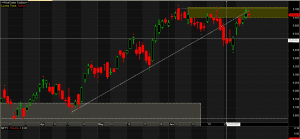

On 2nd July I posted on my website that Nifty looks weak on weekly chart. I took a bear position (on 28 Jun on break of daily trend line). Market did not oblige yet and has moved against me of about 1.5%. But my position is in profit !!!!

This is really possible and not too difficult…. and I am showing how …

Choice of initial position

When you want to go short, you can go for any of the following implementations-

- Short Futures

- Short Call

- Long Put

- Bear Call spread

- Bear Put spread

But Very few people know about a diagonal spread option. Here is the possible strategy with diagonal spread you could have done on 28th June –

-

- Buy Far month ITM/ATM Put (Sep 9600 PE)

- Sell This month OTM Put (Jul 9400 PE)

Position at beginning when Nifty @ 9520

- Long 9600 PE – Sep for a cost of 185

- Short 9400 PE – Jul for a cost of 80

- Total cost – 105

- Max profit potential – 200 (@ 9400)

- Risk to Reward – Approx 1:2

In this strategy getting 1:3 at beginning is difficult. 1:2 is good enough to start with. As we are going to play to be in profit in every situation, the loss or risk as we see here does not make too much of sense.

First Correction

When Nifty Closed above 9600 on 3 Jul – Next day (or towards end of day) we move Short PE 100 Points up

- 9400 PE Squared for 33.7

- 9500 PE shorted for 54.7

Current Position after the above correction as of now when Nifty @9665

Rules of the Strategy – Entry

- Works best in low volatility environment (as current)

- Get risk:Reward of 1:2 or better

- Long ATM or ITM Far month (farthest best)

- Short OTM current month (Based on your target)

Rules of Strategy – Correction & Exit

When Market moves against you

- For every 100 point move and close above it

- Move the short position closer by 100 points

- After the adverse move when market hits your short leg (short Call or Put)

- Close position with booking profit in both the legs

When Market moves in your favor

- When market reaches your target (short call or put)

- Book profit in both the legs

- Evaluate going for next same position (Bear diagonal or bull diagonal)

Happy trading…

If you liked it, please share…

Risk Disclosure

Investing in equity or derivatives or any other market is risky and it may not be suitable for all. Please evaluate your risks before doing anything with your hard earned money.

This presentation may include market analysis. All ideas, opinions, and/or forecasts, expressed or implied herein, information, charts or examples contained in the lessons, are for informational and educational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets

Financial success depends on various factors internal and external. We don’t take any responsibility for your financial success.

some really great information, Gladiolus I found this.

plz tell the options strategy to learn and earn regularly

There are many, based on your personal preferences and market condition. Currently Nifty and most of other stocks are trading with low volatility (IV) in this scenario debit strategies work the best. Calendars and diagonal spreads are also good candidates… You will find some of those in my recordings already.

Then, as results come, you can do option selling on specific stocks…

I will be covering a lot of those here in time to come…

Hi Milind,

Nicely explained strategy in low volatility environment. I have few questions:

1. Any guidelines to chose how far ITM / OTM strikes to be chosen?

2. When to hit SL when moved against position, close above ITM strike price?

3. I am inclined towards back testing this strategy on BNF weekly vs monthly options. Any back testing results from your side?

Thanks once again.

Thanks Sushant for your questions. I have been backtesting this strategy for last few months and found it interesting hence shared. I have mainly done this in Nifty. I have not tried with BankNifty and would like to see your feedback on the same.

Strike choice – I choose long option to be ATM or next best ITM. For the short side, I choose my very first target from my technical analysis and reevaluate when this target is met. If I believe another leg of moment is pending, I would book profit in first and go for next one. I dont like keeping very far ITM options in Indian market as they get very illiquid. Most important, I want my risk to reward to be around 1:2 or better.