A lot of people ask me on continuous basis for tips to buy good stock. In the past I showed simple way to evaluate stocks which have been going up. Here we take the story to next level to understand how large investment houses choose stocks to buy. So if you want your investment to beat an index performance like Nifty – read on.

This blogpost is linked with a video which gives about 5

0 odd different examples. So I highly recommend you watch the video after you read this blog.

basics of relative performance

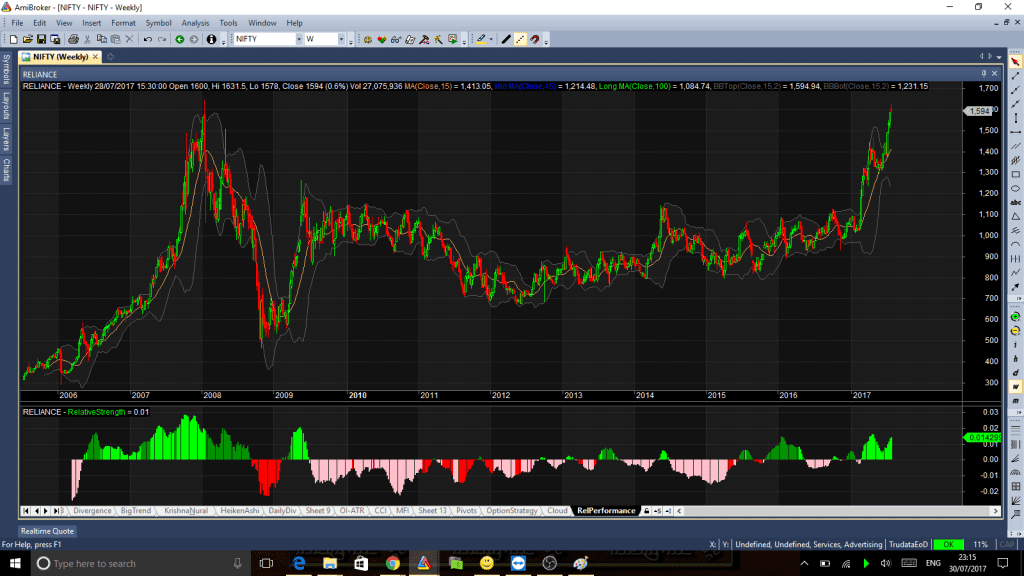

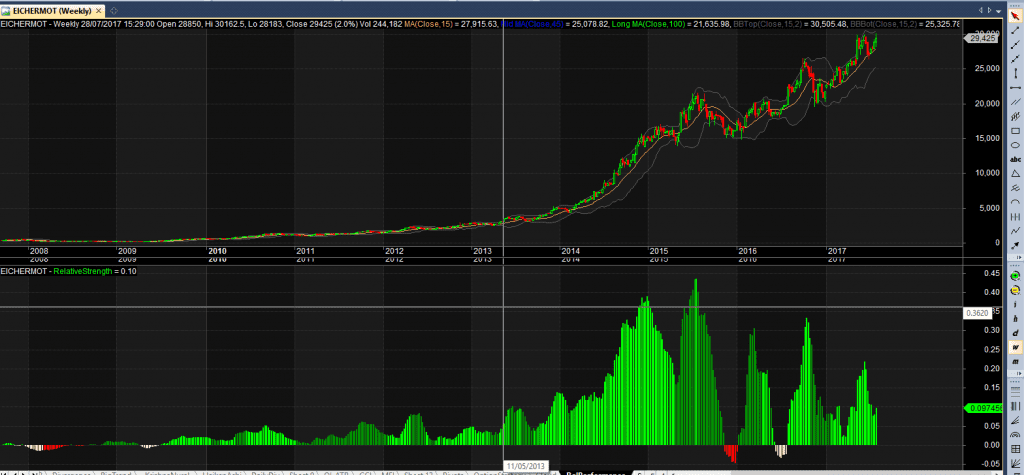

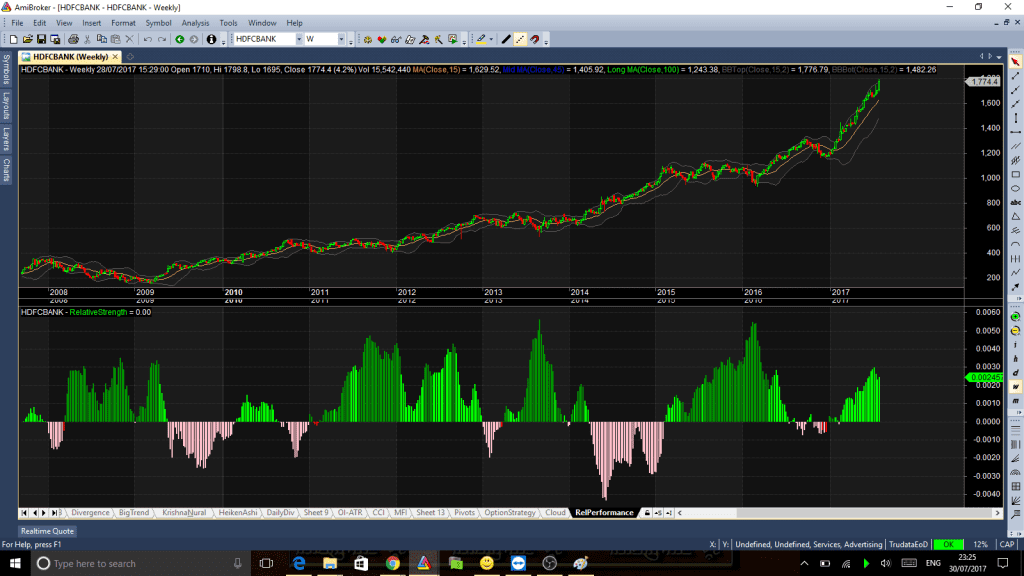

Every stock has a closing price and if you create a composite by dividing this price with price of an index you get relative price of a stock, If you find rate of change of this relative price, you can find if its improving or not. Now, if on a continuous basis this relative price is improving that means its over-performing the index. And if its going down its under-performing the index.

This under and over performance can be evaluated by looking at moving average crossover of this relative movement. And that is all done in the AFL. Here are some of the examples.

Looking at the sample charts, you can easily and quickly identify which is the better bet if you want to invest your money. This assumes however that undeline index used is in a long term bull market.

[activecampaign form=11]