This week we are going to be looking at one of the most important dimension of Chart analysis, the volume. While many people would tell you to include volume in your trading, not many will be able to guide you to use it in a right way. Here, I make an effort. Hope you would like it.

Before we go ahead – here are those 3 indicators that I talk about in my video with their basic understanding.

Best way to use these:

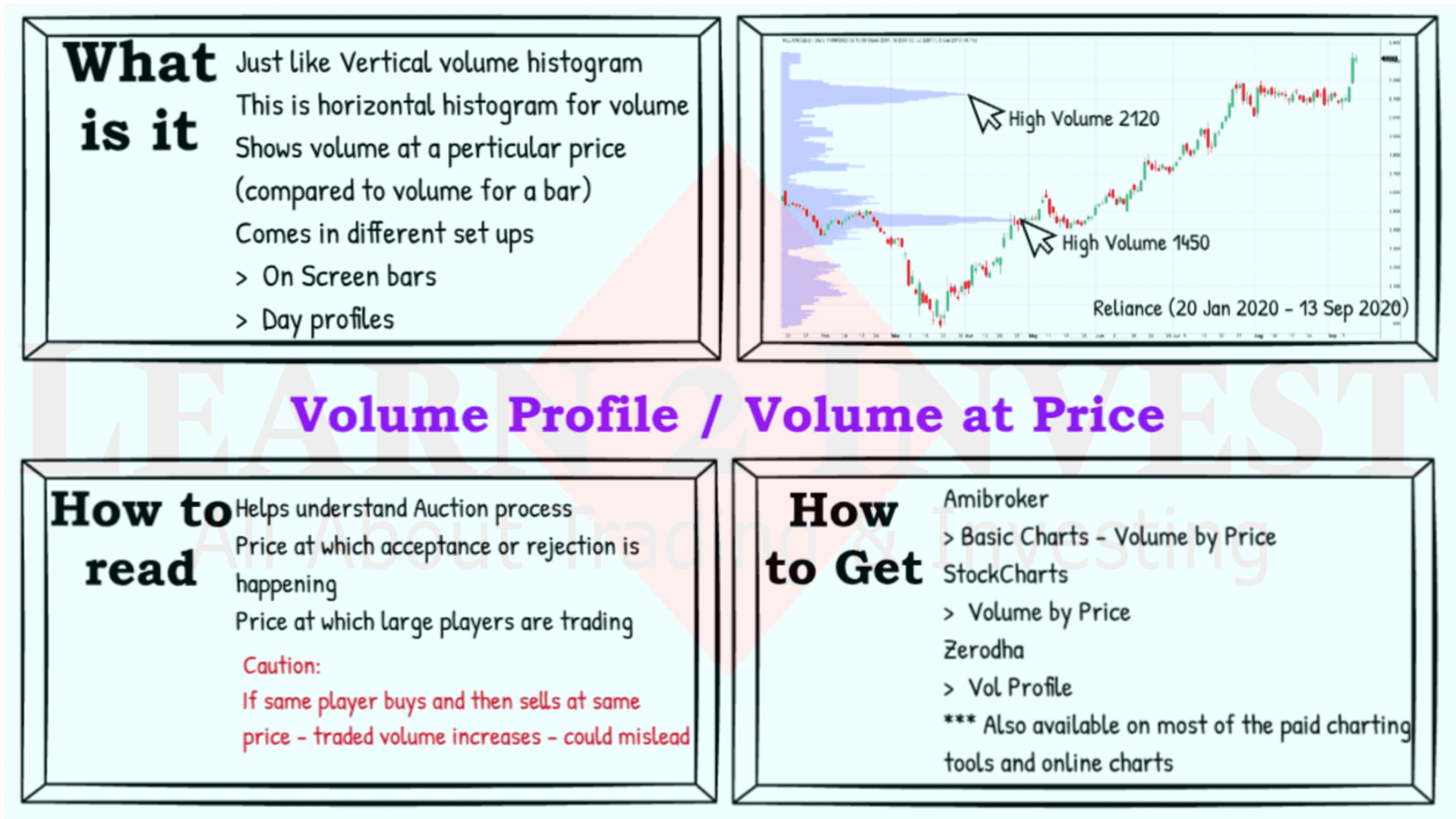

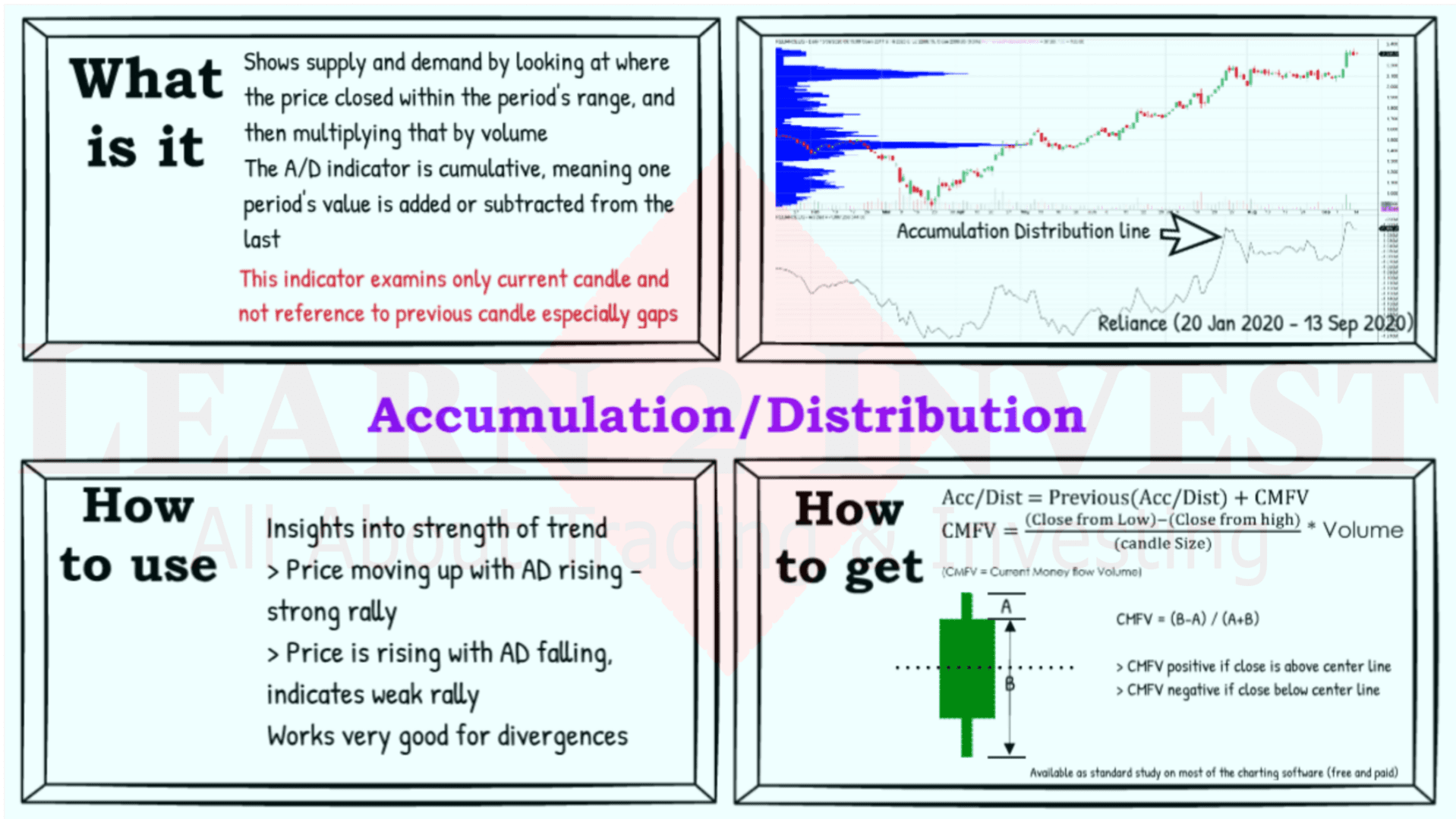

First and important item, on volume profile where volume is high, markets tend to spend some time, this is where accumulation distribution happens. These are areas which often get tested by market. Low volume areas are areas where markets mostly move very fast. Using this principal, we are going to use high volume areas as target zone. And low volume areas as SL levels. Its very important that you trade with a good risk reward. I plan my trade only if I get 1:2 or better risk to reward.

Entry Criteria and Trigger:

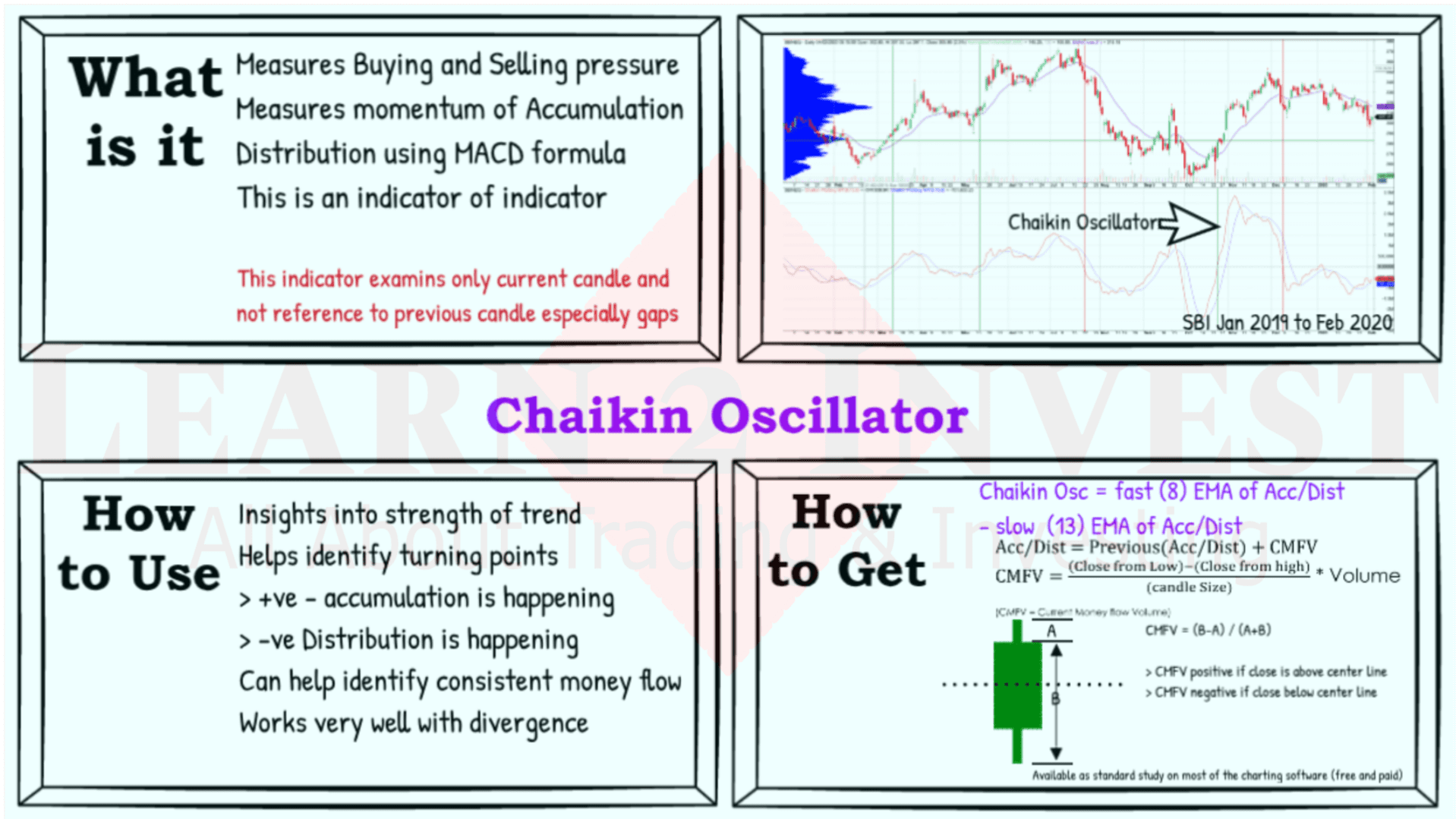

- Entry Rule 1: Divergence in Price and Chaikin Oscillator

- Entry Rule 2: Trend break of Chaikin Oscillator

- Trigger: Chaikin Oscillator crossing 0 line

If you are interested in details with examples, please watch this video –

Next we are going to be talking about wonderful trading world of Option selling using Bollinger bands…