Are we going to start correction in December 2019? 12,155 is the key…

Most of my analysis for higher timeframes is same as provided earlier, if you want to refer, please look at earlier posts at https://learn2invest.in/blog/

On 14th November, we mentioned that a possible correction is on its way and one has to be cautious. Since then market has shown strength and makes us wonder what is in markets mind. Today is a setup we see which is unfolding the story.

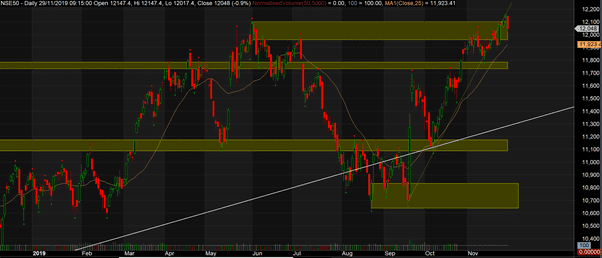

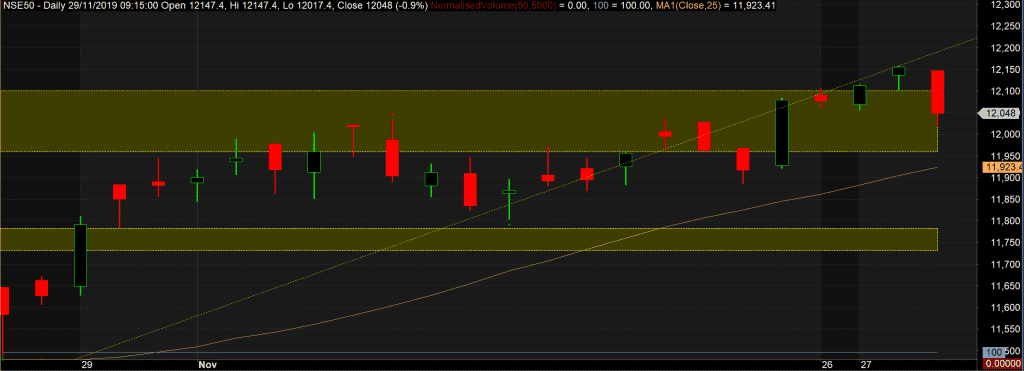

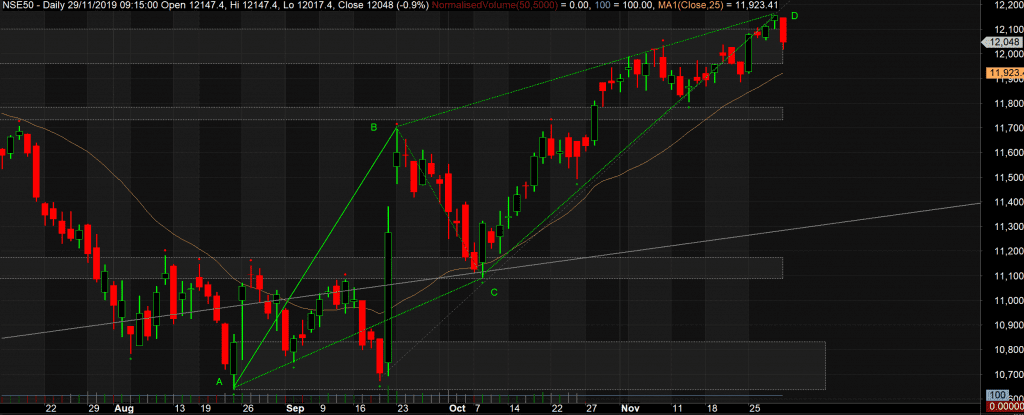

Nifty daily

If we observe carefully the last 2 bars, Bar on 28th November had actually broken the supply area and printed itself completely above the supply area.

If we observe carefully the last 2 bars, Bar on 28th November had actually broken the supply area and printed itself completely above the supply area.

Above this bar, one should go long with open targets. But on 29th we see a long red candle.

Above this bar, one should go long with open targets. But on 29th we see a long red candle.

For harmonics trades, 28th was a perfect AB=CD set up.

So the selling we experienced on 29th could very well be initiated by the harmonics traders.

So the selling we experienced on 29th could very well be initiated by the harmonics traders.

Next week is going to be crucial from the point of view of the direction. If we close above 12,155 then expect markets to continue its upmove and to go to 12,500, if we are not able to break those levels expect a move at least to 11,800 levels.

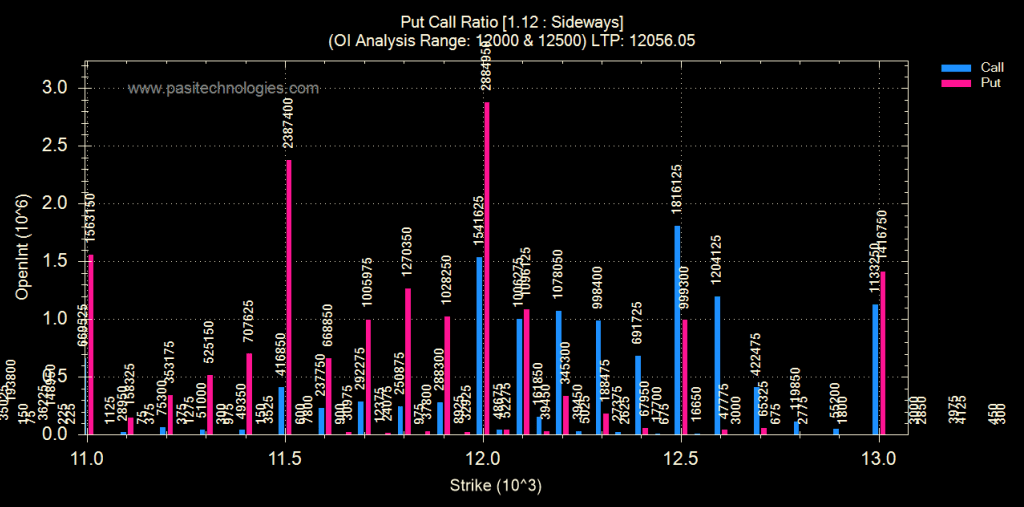

Options data

Put call ratio has an interesting story to tell.

Put call ratio has an interesting story to tell.

Huge put writing is done at 12,000 PE December. These writers would try their best not to let markets go below 12,000. Highest call writing is seen at 12,500. Expect that to be higher level target for bulls for December.