We don’t have much to say for last few days as markets are in sideways move. We are into a wave 4 or wave B (sideways move after a directional move). This is most difficult wave to trade as different indicators will give you different view and many a times those indicators give a misleading information. Best is to keep out in such markets which we have already mentioned https://learn2invest.in/nifty-has-major-correction-started-possibly/

This Blog is just to take status check after last budget for Modi government.

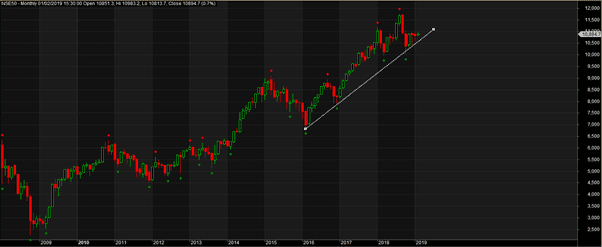

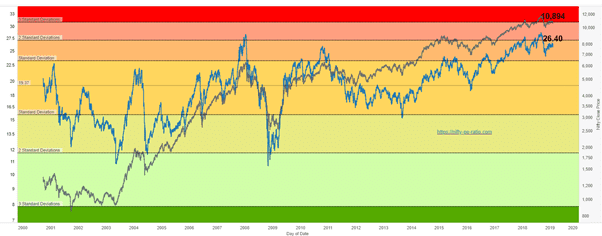

Lets start with Monthly (for higher timeframes, please see earlier posts)

We are very much on a uptrend in Monthly timeframe. And one could have added some at 10,000 around looking at the trendline

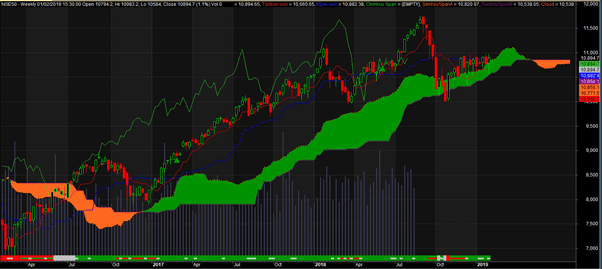

On weekly we see a good demand area around 10K

On weekly cloud, Nifty has been taking very good support of the cloud

But future cloud is red which keeps possibility of a break still alive

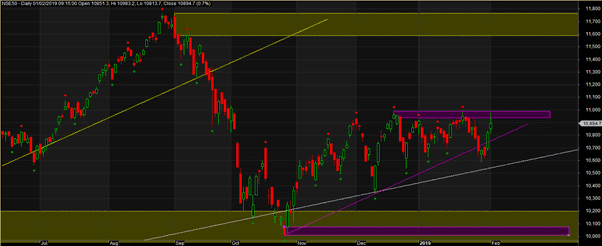

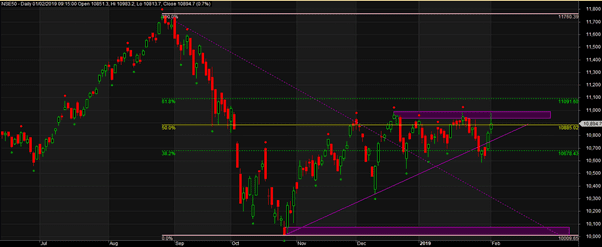

On a daily chart we saw a break of trendline on 29 Jan which promptly was bought into to see good recovery for expiry on 31st followed by a mini rally on 1st on budget day. But now the market is right at daily supply level.

That same level was a perfect cloud support

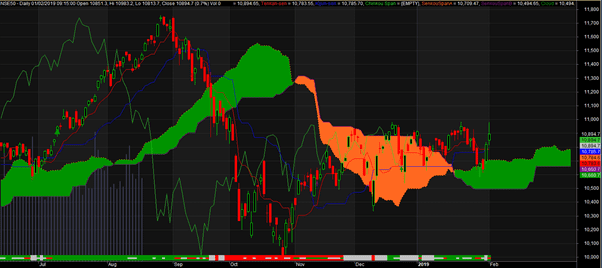

Lets look at Fib levels.

We are right between 50% and 61% retracement

Nifty PE chart still shows overbought levels for PE ratio. A very significant rally from here may not be very likely.

We believe its too early to call the correction to be over and that there is a high chance of a triple (intermittent) top to be printed and we may correct in days to come to 10,000 levels where another review needs to be done.

However if one is super bullish and still want to take risks, Havells (CMP 738.9 SL 650) may be a good bet which is making all time high already…

Nifty tested 61% retracement of recent fall last week and started coming down from the levels.

One may use those levels as SL and take fresh short. Risk reward looks very good.

But if those levels are broken a decent rally may come.

For option traders, long butterfly (March) may be good idea as a large move is expected on either side