As a beginner in stock investment you must be looking for tips and a lot of times even the people giving tips are not knowledgeable enough and at times they give you tips after all the movement is done in a particular stock. My goal here is to equip you to be able to take your own decisions. Even if you are following someones tips, you can use this method mentioned for equity investment to evaluate if a particular tip is good or not.

On 5th of May I have published a video illustrating an example to be a good opportunity to watch out for – Arvind mills. It has taken 3 months of patience to see this stock into a buy zone today. When I say investment is a game of patience, this is what it really means.

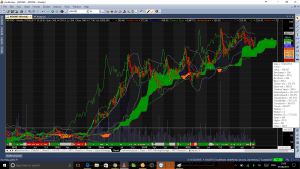

Lets start with the Monthly Picture of this stock –

It has given more than 6 times return already in last 4 years. Monthly Cloud is thick green suggesting continuation of the same. This stock definitely has a potential of outperforming Nifty.

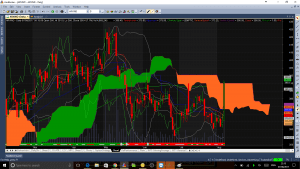

On Weekly,

it shows correction to the cloud boundary which makes it to be a good buy as our stop loss is going to be put when the stock breaks cloud on weekly charts. This helps us reduce risks and hence increase return on risk.

On Daily

And Now is the time to enter this stock, because as per our rule mentioned here –

We have daily cloud burst, price crossing R3 on daily. So today it gave us perfect set up for the entry –

Company declared results on Friday which are in line and more importantly made remarks that it expects profitability to improve with lower raw material costs. The stock has definitely reacted to this news. Now a simple question to ask is, will you be hearing similar news again and again. And if the answer is yes, you should simply go ahead and buy this stock…. One may wait for todays high to be taken out just to make sure that its not a fake break.

What should be Stop loss?

On 28 June stock made a recent low of 353. I would use 350 as a stop loss. If you have seen my supply demand blogs, you would know that this is a very good level of demand as the downward trend line is broken and todays close has started a new upward trend line. I will not have any target for this stock and I expect it to outperform Nifty over a period of next 6 months and above. I would use my quarterly evaluation rather than having a target based exit with about 12% of Stop loss in place.

Most Important note:

This blog is only for learning purposes, there are few more things like money management etc. that should be taken into consideration. And most important equity investment is risky. Evaluate your own risks.