This week we look at how to invest in stocks. This article should be simple enough for new investor and comprehensive enough for an experienced investor.

This is a little longish blog and if you like listening to video, sharing one of my old videos on the same subject. While both these things are little different, but core messages are the same.

What does it mean to own equity?

Lets say you have a friend doing business and he is in need of cash for buying new equipment. He comes to you asking for money. You can give your money as loan or better, you can also ask him to give you share of his business. When you negotiate amount of share in his business he is willing to give, you need to do some sort of profitability, revenue analysis (Lets not get too complicated here). Based on that analysis you decide that lets say for 1 L of investment, he is willing to give you 10% of stake in business. What that means is that whenever he takes out profit from the business he will give you 10% of the same.

Just the same way you can hold small part of ownership in any listed company (Stock). The only difference is that you can sell it on an exchange to anyone who is interested to buy the stock. If there are more buyers, you can demand higher price and if you are desperate to sell and no one else interested in buying, you get lower price. Because of all these changes in price that is continuously happening, there comes an opportunity to earn a good return just by buying and selling the stock. Real investors however believe in the share of profit (called dividend)

Which stock to buy?

I hear a lot of people saying buy cheap stocks. But let me ask those people, if they need to buy clothes which clothes they actually buy? Something that is cheap and not so good, or something that is branded and much better in quality, even at higher price? If your answer is second, then you need to relook at the choice you make while buying a stock.

Second myth I hear is XYZ analyst has a very good understanding of market and his calls are perfect. But if someone really knows which stock is going to go up, will he buy for himself or start telling the world about it. In reality, if you were him, what would you do? They first buy for themselves and then to get the prices higher, they ask public to buy and when public is buying, they actually sell their holding.

Third myth is that fundamental analysis is best analysis. In my limited knowledge, experience and understanding, nothing is as accurate as supply demand decided prices. If a stock is fundamentally good stock, there will be people doing required research and may be already buying the stock and the prices may reflect. Another major factor deciding prices is speculation. Everyone wants to buy first and end up buying even before the news is out (only on rumor) and by the time you know the good news, those speculative buyers are selling and you end up buying at the high of the price range. I am not against fundamental analysis, but to me technical analysis works much better.

Next, a Rs. 50 stock is relatively cheaper to Rs. 500 stock. yes, I have met a lot of educated people doing investment in stock market with this understanding. In reality, you may be comparing price of potato to be Rs. 20 KG to price of gold which is Rs. 28,000 and saying potato looks to be a great buy!!!

How to do Technical Analysis?

This is really a vast and very interesting subject. I have spent hours looking at various charts and indicators. I have created hundreds of my own indicators. I have taught and even now teach use of various indicators. I am working on the most cutting edge machine learning based indicators.

After all the research came to a conclusion that these are very nice for detailed analysis but make things complicated in taking actual decision. After a very careful analysis, I am giving you the best and most effective indicators that will help you identify the right stock and also the right time to buy the same. I myself use these in my own analysis.

In this simple method, you just need to see 2 simple things

-

Trend is friend

- Is it going up or going down?

- Is the trend changing?

-

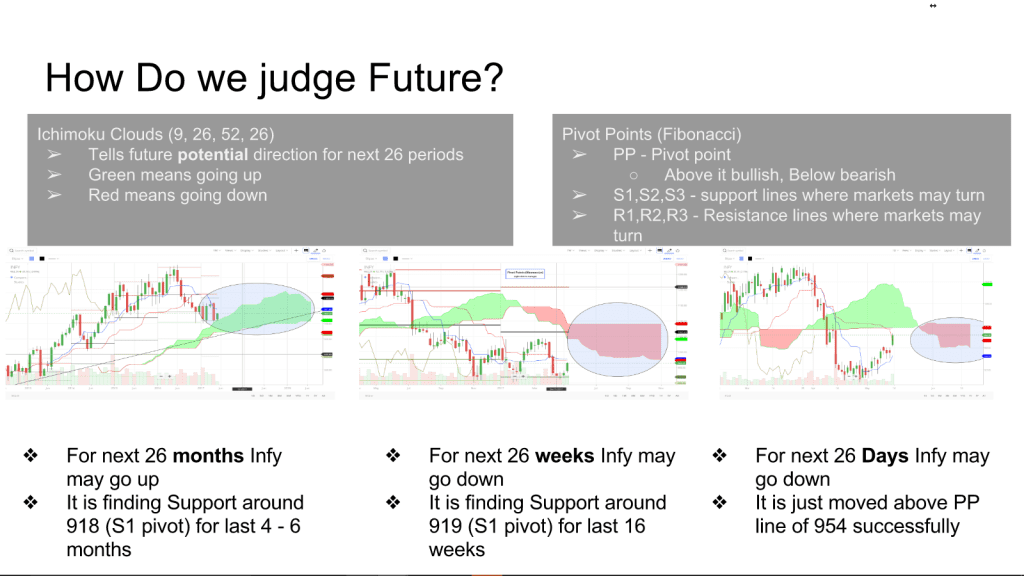

How does the future look like?

The above chart will help you decide what the future should be. Remember, this is only based on statistical data that more than 70 odd percentage times this worked in the past. Does not have any guarantee that it will always work for you all the time.

We look at following –

Pivot Points and Ichimoku Cloud

While both of these are fairly complicated, we will use it in very simple terms with clear rules. (The more you make it mechanised, the easier it will be to take timely right decisions).

In Ichimoku clouds we will only look at color of future cloud. That is how simple it is!!! Pivot points, above PP line is bullish and below is bearish with understanding that at support and resistance lines the stock may change direction.

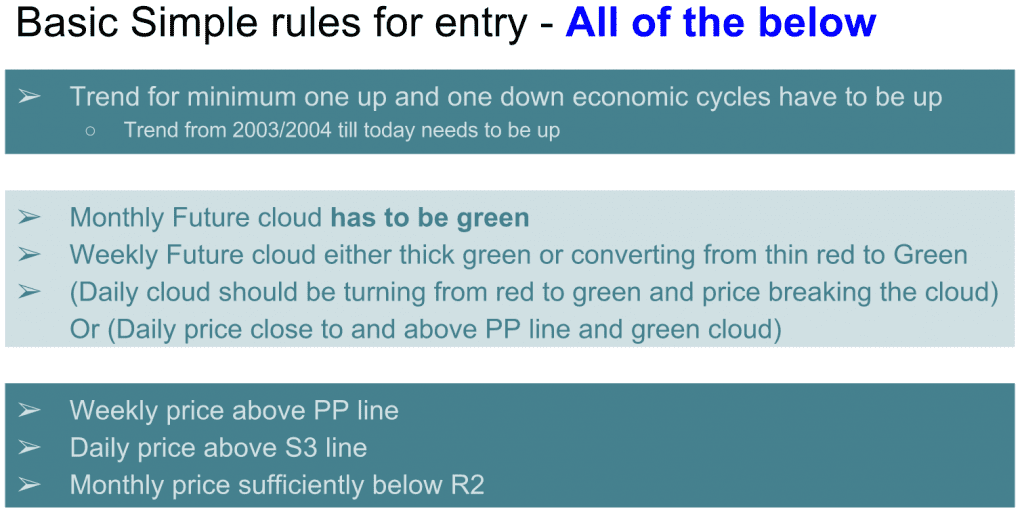

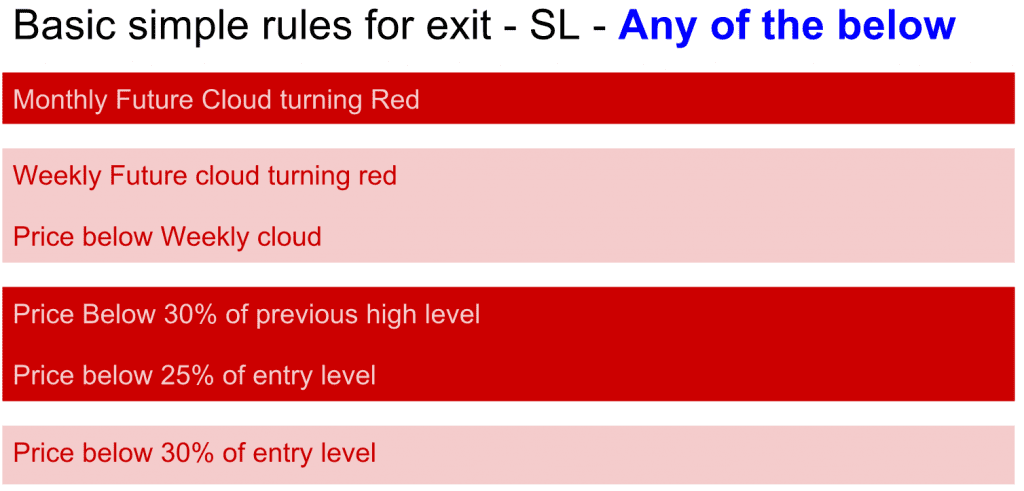

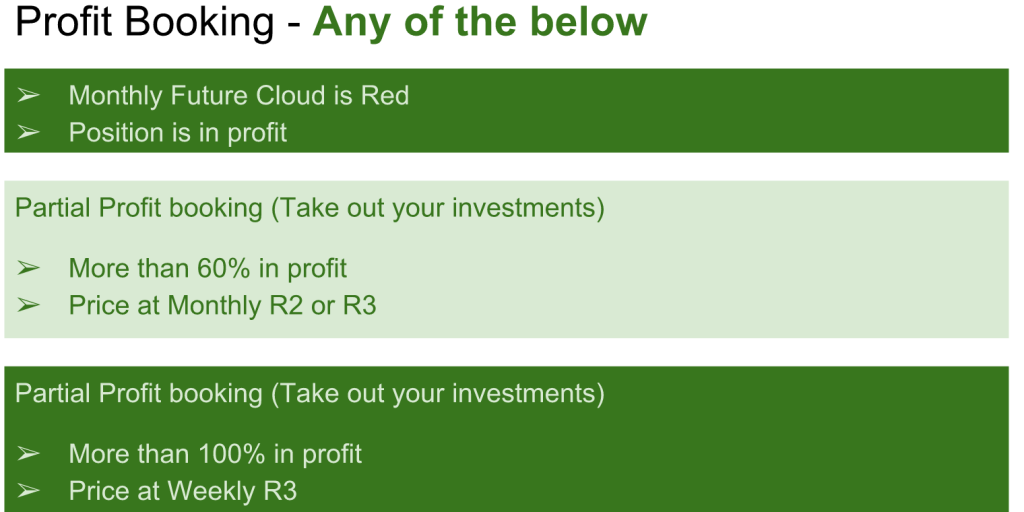

Following charts show exact entry and exit rules. They are self explanatory, In case of doubts, recommend you watch the video at top of this page.

Last tip –

If you are starting to build your portfolio from scratch, buy only top 50 stocks from Nifty universe.

If you wish to get access to the Presentation used in Video, please fill up the form below

[activecampaign form=5]

Hi Milind,

Nice informative blog. Not used pivots n ichimoku cloud so got interested to explore now. Anyway I am on compulsive bed rest 😂 which is giving me much needed time break. Just completed Reminiscences of Stock Operator and starting Wizards series. Once I ‘ll be able to operate laptop planning to start with back testing. Major issue I found is illiquid far month options.