Double top on charts is one of very common trend reversal pattern. Right now Nifty touched (11,729) high made on 28 aug 2018 (11,760) and has retraced from there. In markets as per standard rules of double top, unless Nifty does not break swing low of 10,004 made on 26 oct 2018, we technically cannot call it a double top and if it does technically it should come down at least by the same difference (11,700 – 10,000 = 1,700) with a target of 8,300. Those who are in markets in last correction in 2015 would remember how important this level of 8,300 was.

Now lets evaluate if we are really up for a major correction?

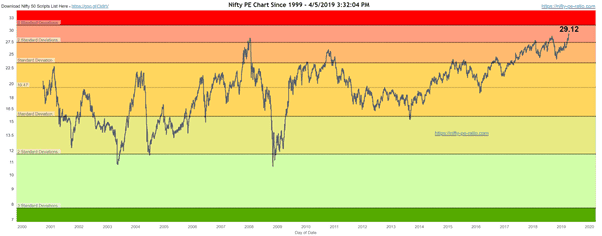

Nifty PE ratio is at all time high –

It is seen in the past that whenever nifty PE was in 3rd standard distribution, a correction of upto 50% has taken place. Remember that markets can be irrational for longer period than you and me can have patience. Do not use this as a strategy to go short. But definitely investors need to be cautious and should take out money from the table if their investments are not giving good returns. In a 50% correction, even best of stocks correct upto 30%. And weaker stocks may actually correct even upto 80%.

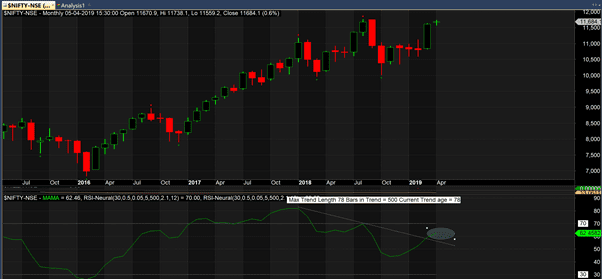

Monthly Chart

On Monthly chart, we see a double divergence on RSI. (Last point is for April which is not yet over and if we go down this month, the RSI value will be lower). In about 80% of cases double divergence result in a direction change.

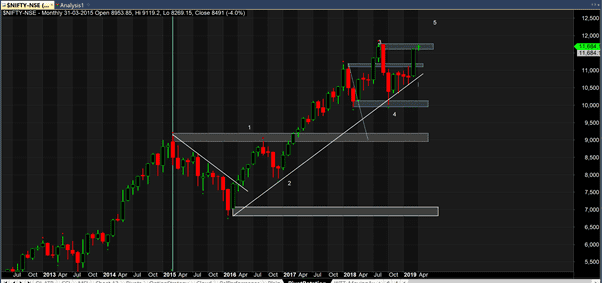

Weekly charts

While I see a possibility to complete wave 5 on weekly charts (details in my last post) there is also a possibility that the 5th wave may be truncated. We would know it by close of this month. We also see a doji on weekly chart. But only after next week we should be able to confirm I that doji should be considered for turnaround.

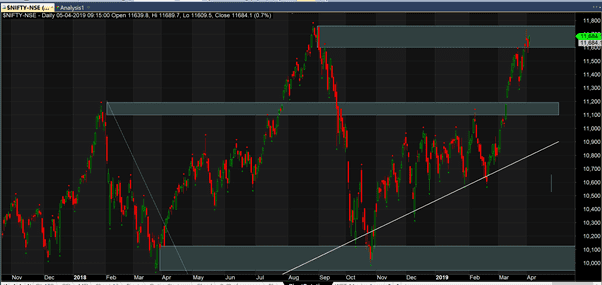

Most important, we are at a daily resistance level and a break above 11,800 is necessary for us to deploy new capital. Please wait for confirmation on weekly before taking out your capital.

Daily charts

I see a possible retracement to 11,200 before we trying to break 11,760 levels. This is another very good risk reward trade where SL is around 11,800 (120 points) and target is around 11,200 (480 points) – risk reward of 1:4. However, please remember that there is no trigger for this trade yet and if you want to take it – do it at your own risks.