From the past blog (https://learn2invest.in/nifty-analysis-post-20-sep-fm-announcement/) on 22 Sep.

“Looking at all this, we don’t see a run away rally from here on and we recommend investors to wait few days and go long stock specific only in stocks which are showing strong momentum. We also recommend strict SL and effective risk management.”

Thanks to markets for giving us enough indication to recommend with clarity. We are sure, our followers are getting help from these.

Lets start with current analysis.

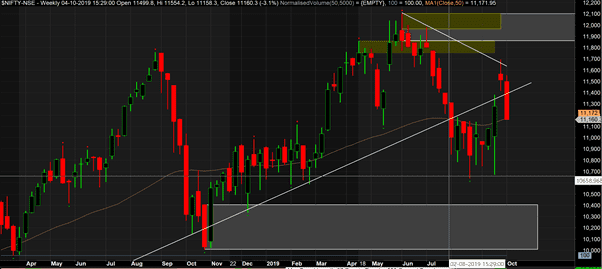

Nifty Weekly

We have not seen any important change from Monthly chart. Its same old triple divergence on a lot of oscillators. And a sideways move after that. So we would skip it this time also.

On weekly charts, it has very nicely respected the downward trend line and also has come down below a long trend line all the way from march 2016 bottom of < 7000. As per our definition a proper break of trend line happens only after we see a full bar below this trend line, till then, one may use lower time frames or assume it to be sideways. Next support around 10,400.

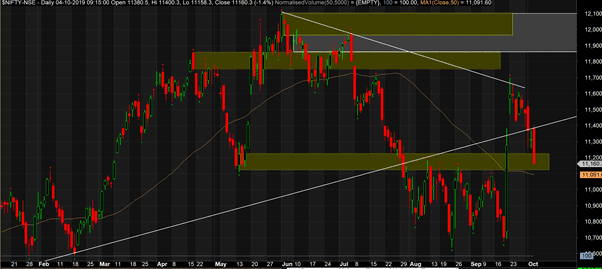

Nifty Daily

On daily charts, we broke this trend line on Thursday and retested it again on Friday. Bit now prices are right on top of an earlier demand area. For us to confirm a downtrend on daily we want a break of 11,100 levels. Even then looking at past structure around these levels, we expect markets to go sideways before a major aggressive correction sets in.

Also please remember that governments can do wonders to markets. And if a strong and powerful government wants markets to go up, they usually can… So be careful taking large shorts in current scenario.

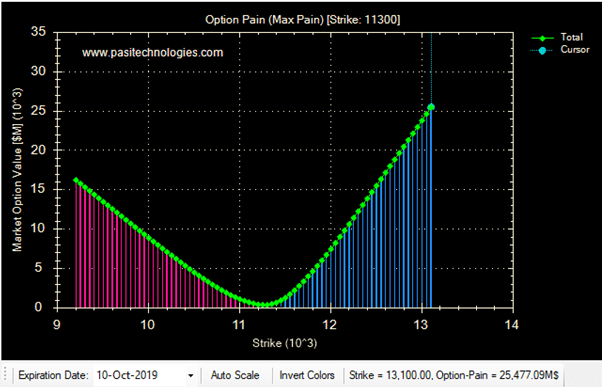

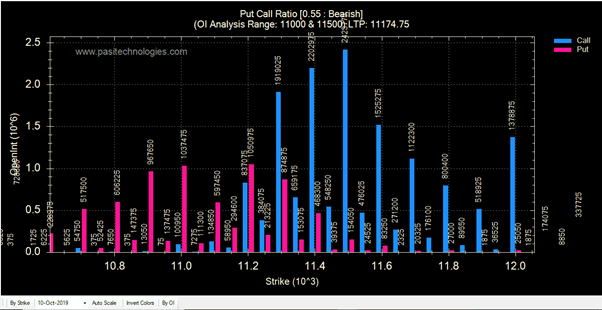

Options Data

Option pain still remains at 11,300

But Put call of 0.55 ratio is completely skewed towards sell

As per put writing, there is only a minor support at 11,200, 11,000 and 10,900 levels beyond which there could be a freefall to markets unless net put writers come to rescue.

Final Take

This definitely is not best time to deploy new capital. Nifty direction is sideways with negative bias. We believe, 11,100 levels may get broken and Nifty may eventually come down to 10,400 levels in next 3-6 months. Around that time we will need to re-evaluate decisions. (Or of course if we are able to take out all time high before that…)

Till then hedge your positions or simply reduce exposure to stock markets.