From last post Budget Analysis

In our post budget analysis, we had mentioned “Level of 11,580 is a crucial level therefore. If Nifty comes below this level, in no time it should come down to test 11,170 levels.” And that is what we witnessed in last few days. Lets build our today’s analysis on that analysis

PE Analysis

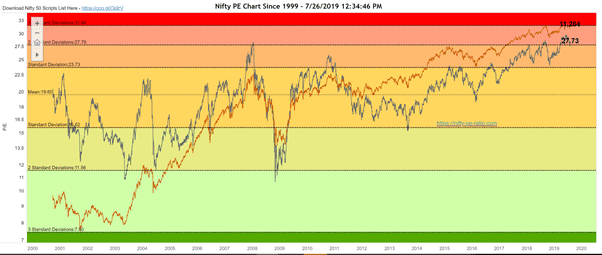

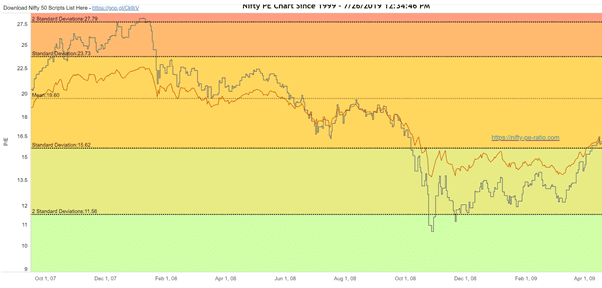

Finally PE ratio has come down to 2nd standard deviation. This first happened in 2008 when markets came down from 6,200 to 2,700. About 56% correction from top. That was move from +2 SD to -2 SD. Here is the chart –

After 2008, this happened only in recent times in Sept 2018. When PE ratio came down from 28.55 to 24.12 (2nd Deviation) This resulted in a 1,600 point fall(14%) in Nifty from 11,600 to 10,000.

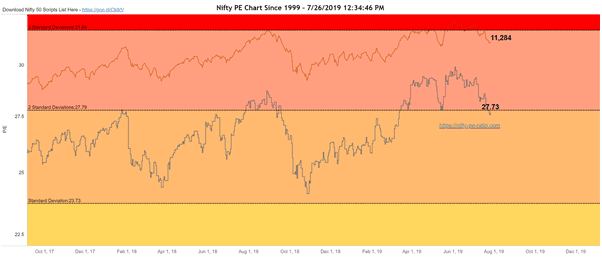

Monthly View –

Second divergence is now almost confirmed as long as we don’t see an exponential rally by 31st of the month.

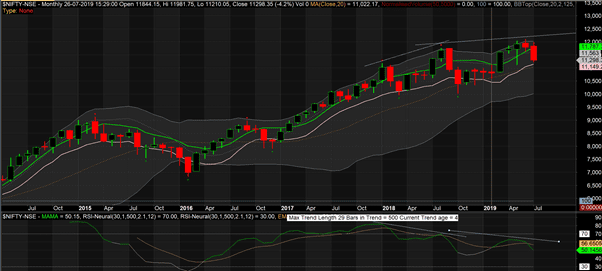

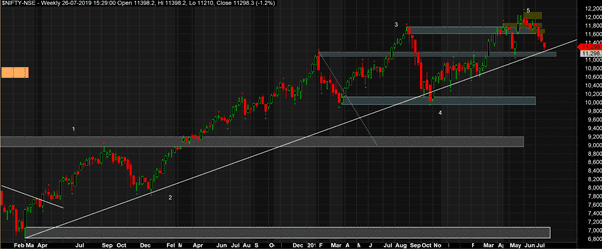

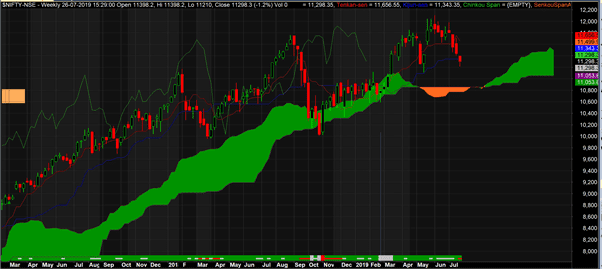

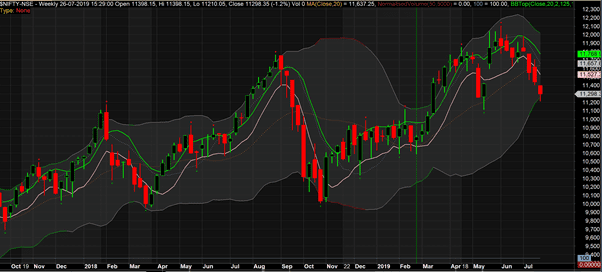

Weekly View

On Weekly charts, markets are very close to long term trend line which is respected by many corrections. The same support is shown on ichimoku cloud as well as on Bollinger bands.

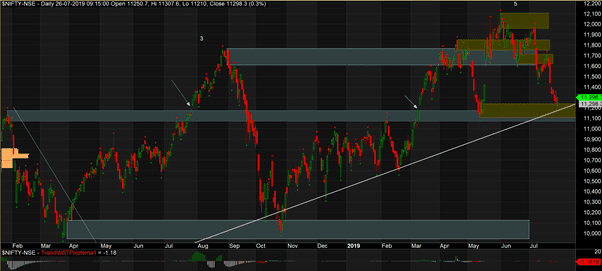

Daily charts

On daily charts we are approaching a very strong support zone. Twice market has broken this level with a gap up. Now weekly trend line is also around same levels.

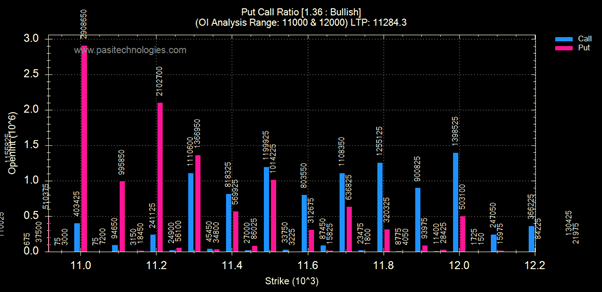

Options Data – August expiry

While markets are cracking, we have a high Put call ratio of 1.4.

This picture shows strength of bulls in writing such a high quantity of Puts against call writers.

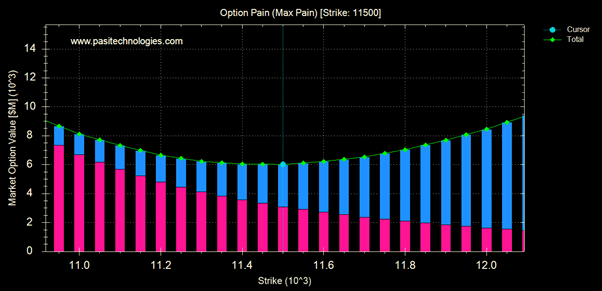

Max pain is a simpler picture with Max pain at 11,500. So currently markets expect expiry o happen at 11,500 levels.

Final take

Based on all of above data, the technical analysis suggests that the bias is towards upside. But since monthly chart shows weakness, this uptrend may not be long lived. So you may either trade an upmove to 11,500 or use this mini rally to reduce longs for a lower targets.

Below stock ideas are only for education purposes for paper trading. Please evaluate your own risks before putting your money at risk. (We ourselves may not trade these as primary trend is down)

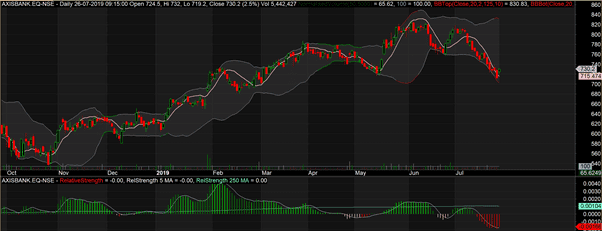

Axis Bank

AxisBank may give a rally to 770 levels in next few days (SL 702)

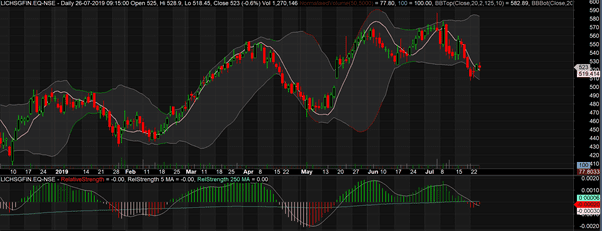

LIC Housing Finance

LIC ousing finance may come up to 550 or even 580+ levels (SL 505)