As mentioned in my series of blogs right here and also on facebook, markets have shown weakness…. Its so wonderful to read some comments that this blog is really making the difference… Recommend this blog to be used as training inputs rather than a trading tip or two.

Lets get to the subject at hand.

Nifty has had one of the worst expiry since 2008 with a decent correction of about 900 points (8%) in Feb from top of 11171 on 29th Jan to a low of 10282 in Feb. Me along with a lot of our followers were able to exit longs and also went short well in time to catch this move.

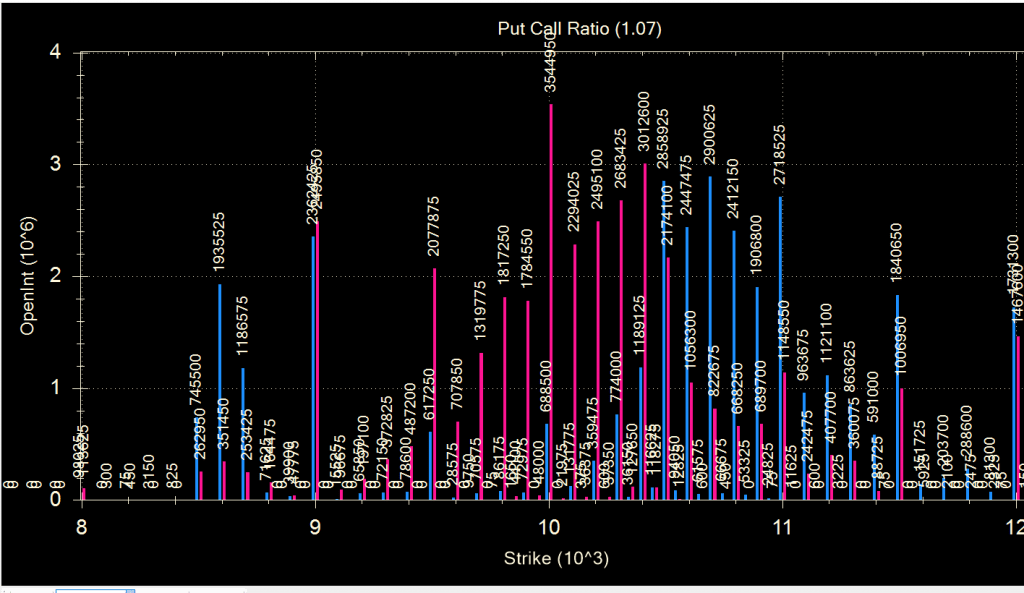

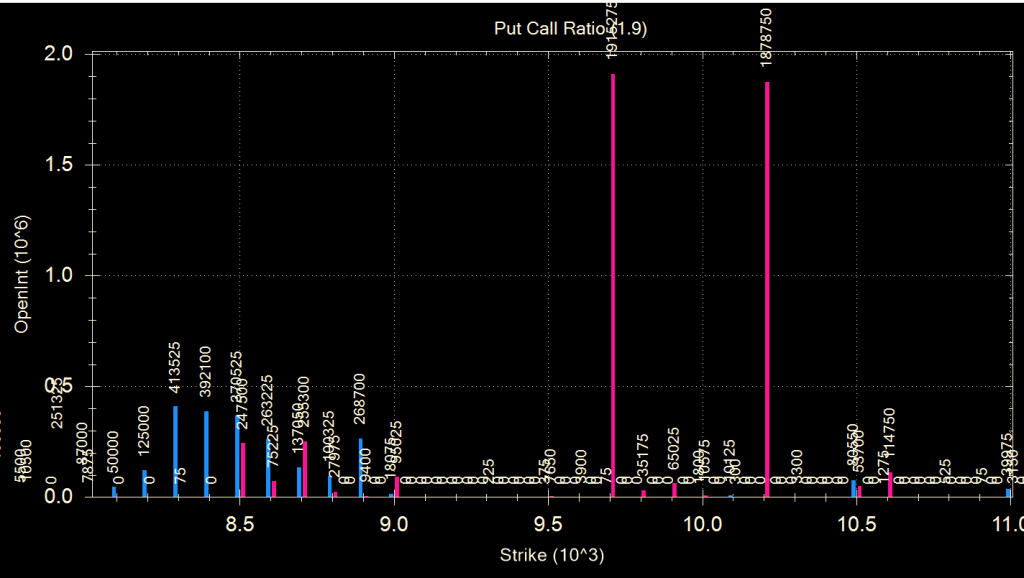

Options Data Analysis

We are seeing a sanity in put call ratio with the ratio at 1.07 (Beginning of Feb this was at 0.75)

Jun OI shows a skew with huge OI at 9700 PE and 10200 PE These are OTM strikes and could be simply normal Put writers who are expecting markets to reverse in Jun. What if this is driven by Put buyers who actually expect markets to go down and want to multiply their capital? Of course a possibility.

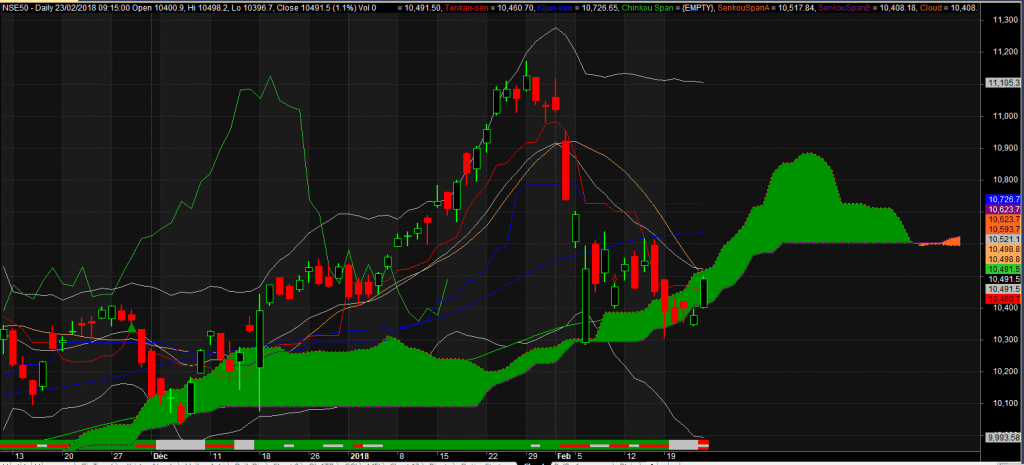

Nifty Chart Analysis

Quarterly and Monthly charts are not giving any different view than last time, If you want to review those click here

Weekly Chart is still very much in upmove with no supply area getting formed yet. If we close full week candle below 10282 (recent low), we would have a weekly supply area at the top. And weekly trend line is coming around 9500 levels for this month. I like such numbers as people also show emotions around such numbers.

In our last post we had drawn first demand which is where Nifty is now spending time… on 6th Feb bulls defended these levels with a recovery of more than 300 points. But on 20, 21 and 22 Feb Bears managed to break this level by having full candle below these levels. For me, this level is broken and all that is happening now is an opportunity to build further shorts with next target demand zones at 10,100 and then weekly trend line support of 9500.

Daily Clouds shows this very nicely.

Nifty has also been able to break daily clouds on 22 Feb now trying to test it. So if its not able to close successfully above the cloud, further weakness is expected.

This gives me a very nice risk reward of about 150 points of SL and next target of about 450 points (1:3) and if my Weekly target is to come, I make almost 1000 points (risk reward of 1:6)

I don’t expect a level of 8700 to come immediately as of now.

Video here…

If tomorrow we break today’s high, shirts should taken off

And the markets did not, so continued with the shorts. Now SL is Tuesdays high on closing basis.