Our last week short term target of 10,015 was bissed by a brisk and Nifty chooses to turn @ 10,031. Here is the update as of 10th Dec

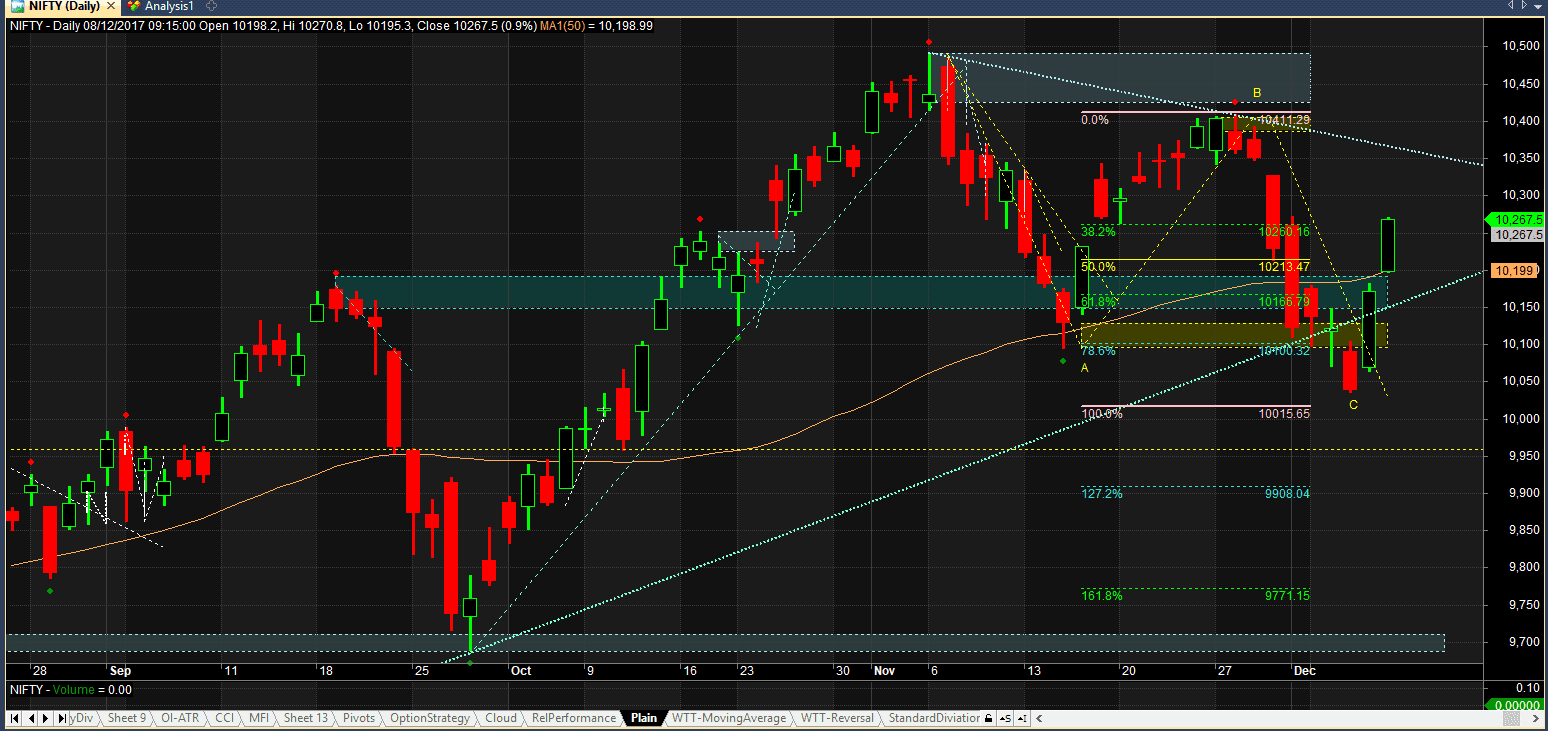

On daily chart

On daily chart last week nifty had a false brake of weekly support line and when everyone changed their views (on television all analyst started talking about downside targets) And immediately on next day it showed prompt recovery. Most of successful traders take position on next day when confirmation is there, so those traders may not have got into this trap. Another group of successful traders are able to change their view immediately and take opposite position, they also succeed in market. But some beginers get stuck with recent indications in market and are adamant to change their view. Those are the traders who make losses in long term.

Till the time we successfully close above 10,500 we cannot technically say that we have changed from sideways to directionally up market. There is a gap which along with the downward trend line has potential to act as resistance at 10,350 levels.on downside similar support comes at 10,180.

We still are working with a sideways market with range of 10,500 and 10,000.

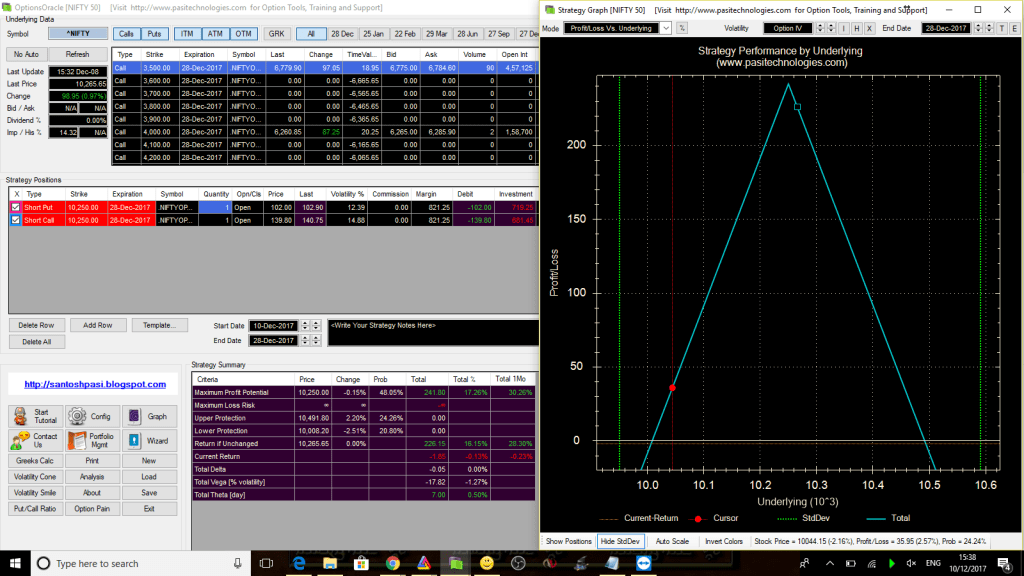

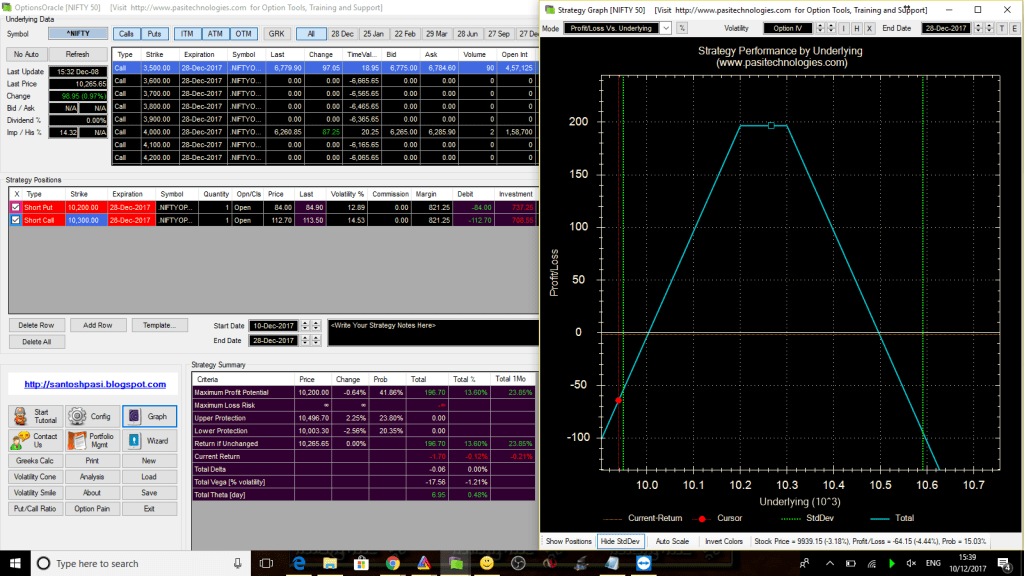

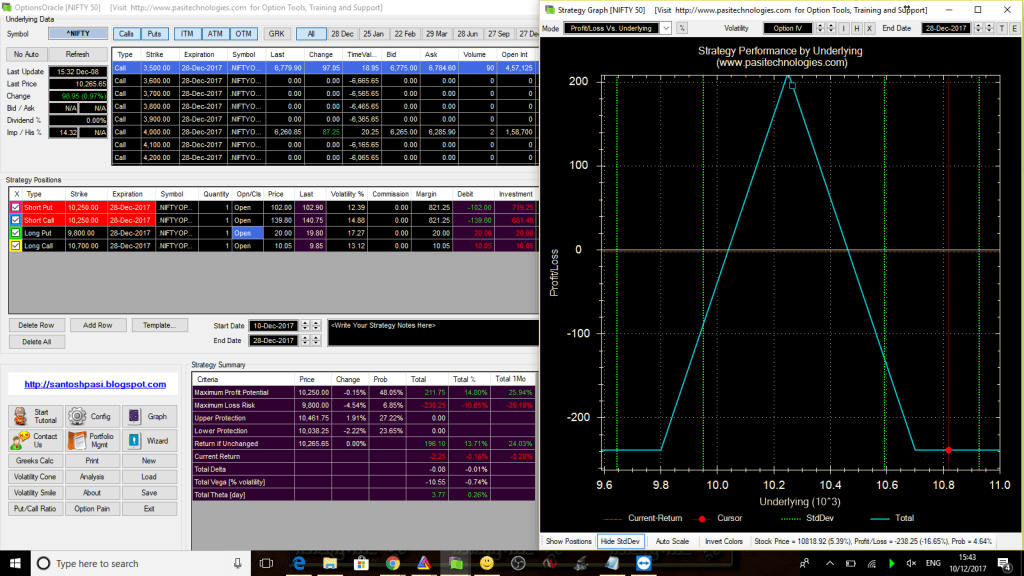

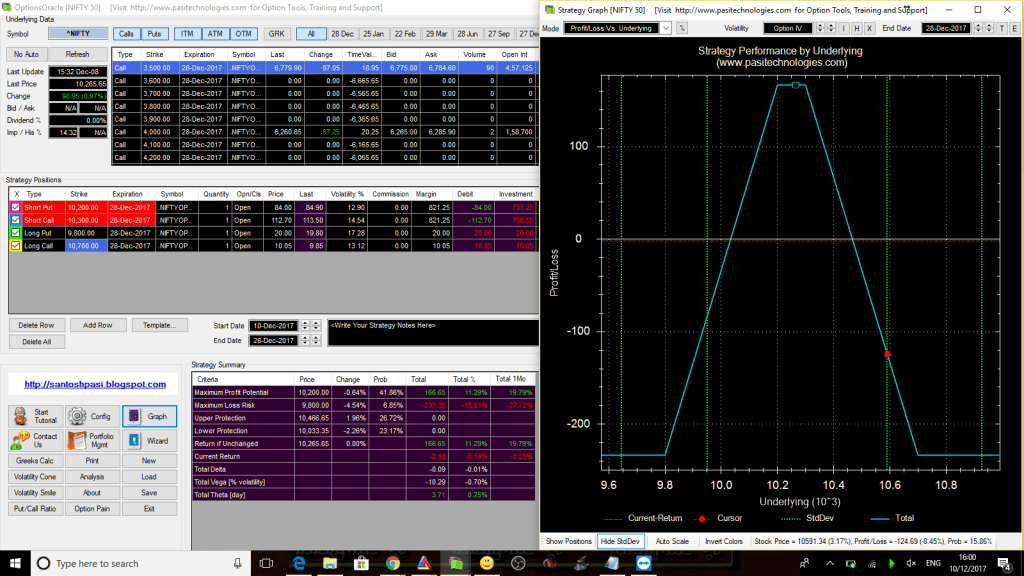

Friday close of 10.250 around becomes middle of the range (MOR) and this is a perfect position to take options trades like Strangle and Straddle. We recommend taking Iron Condor or iron Butterfly in stead. In any case, here are all those 4 trades. Each of these strategies making maximum of 11-20% returns in next 3 weeks (or about 20-30% max return per month)

Its like you read my mind! You appear to know so much about this, like you wrote the book in it or something. I think that you can do with some pics to drive the message home a little bit, but instead of that, this is magnificent blog. An excellent read. I will certainly be back.