Nifty Post-Budget Analysis 20190707

Fundamental View

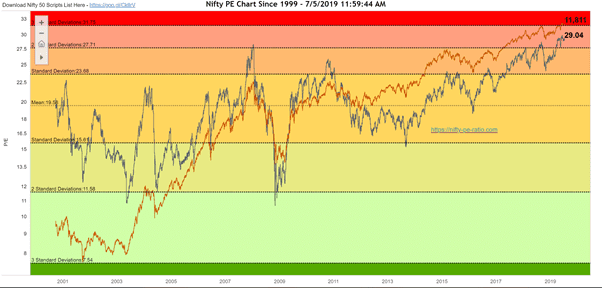

Lets start with PE ratio of Nifty –

Nifty is still very close to all time high when it comes to PE ratio. And such high PE ratio is unsustainable. So either earnings increase or the price will come down. Usually large fund houses do sell at such high PE. However this time they are not selling. Probably because they expected something dramatic to change in the underline policy or businesses. To best of my knowledge, nothing spectacular is coming with this new elected government and hence likelihood of sell off is more probable now….

Monthly Charts

We have talked about this double divergence many times. Apart from this divergence, all other monthly parameters are positive.

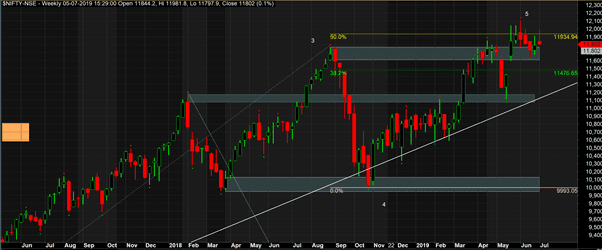

Weekly View

On Election day, Nifty had a gapup to break the weekly resistance at 11,760 closing above. This is a significant resistance which was broken after almost a year. Since then Nifty is finding it difficult to continue the rally. Level of 11,580 is a crucial level therefore. If Nifty comes below this level, in no time it should come down to test 11,170 levels. But until this major support is broken, we have no reason to be short in market.

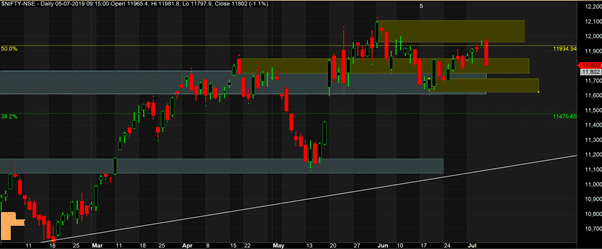

Daily View

When you look at daily, you would see many supply demand areas coming around the current price levels. This is typical of scenario when market wants to go sideways. This market will not show any direction till it either breaks 12,115 on higher side or 11,580 on lower side.

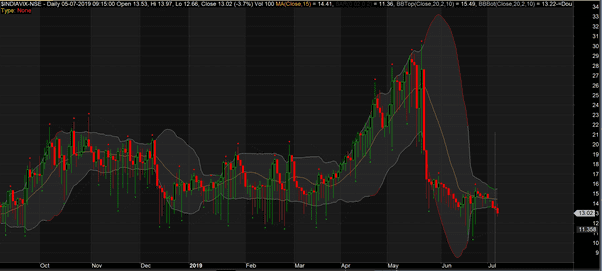

IndiaVix telling interesting story

Pre-budget we saw IndiaVix going to levels of 30 and higher. This happened after 2015 – more than 4 years later. For many years IndiaVix has been at low levels. Again it looks like ready to go lower. But if you consider cyclic nature of volatility, there is high chance that volatility will again start rising and that may very well be first indication of a decent crack in market.

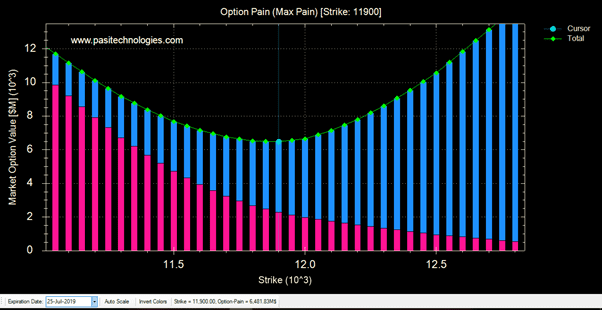

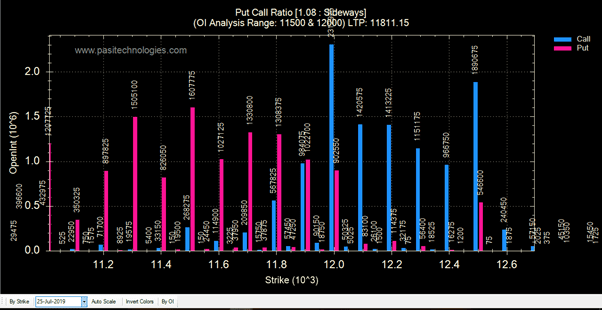

Options Data

For 25 Jul expiry max pain is at 11,900 saying most likely the expiry may happen at 11,900. And Put call ratio suggest that 12,00 is a very good resistance and it will not get broken. However 11,600 does not look to be a great resistance. So one should be focusing more on break of 11,580 levels. All said, please avoid taking bets without enough evidence and a good trader waits for right time before taking a shot.

Some stocks to watch for

Today we provide with some interesting stocks to study so that you are able to learn more form the price action.

COLPAL

Showing a nice uptick on relative strength on weekly charts. Decent risk reward.

IndusindBank

Decent long set up again