After the fall happened post budget, lot of people are asking where is the best place to buy Nifty again and what should be their strategy. This post tries to answer the question.

I am lucky to have got a lot of my analysis right and that does not mean I will be right all the time. This article should be read from learning the way to analyse rather than simply following…

This is a longish article.

Technical Analysis –

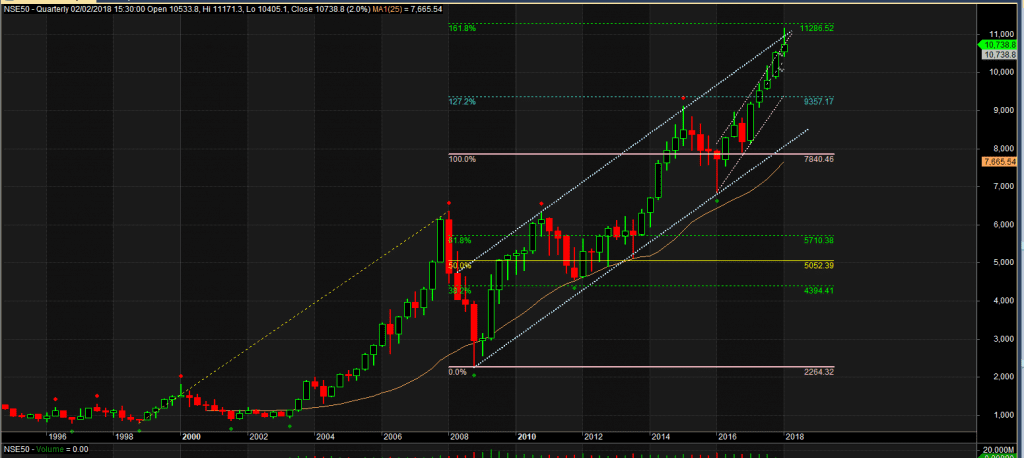

Quarterly Chart

We are at resistance levels. In terms of probability and return on investments, very high chances of a fall. But the charts look all bullish.

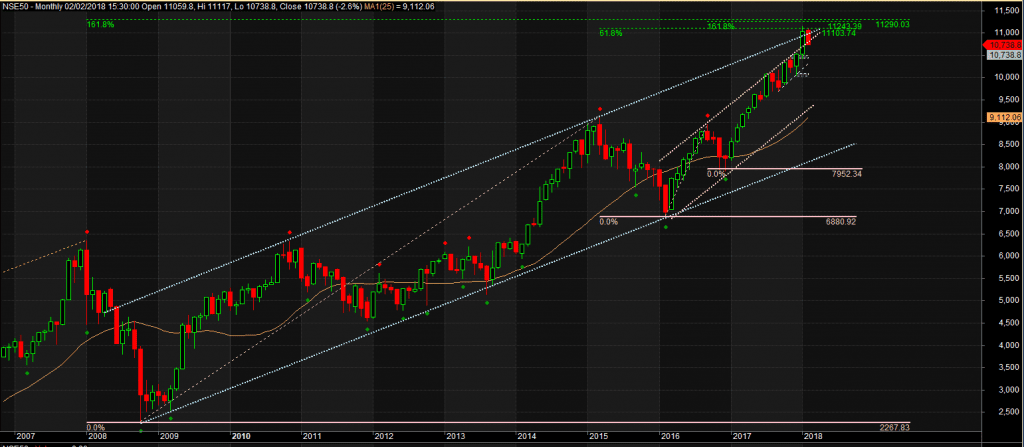

Monthly Chart

You may observe that Nifty was close to many Fib targets. Its healthy for Nifty to correct till bottom of the channels at 9,500 (10% from top) or even 8,500 (23% from the top) levels. Beyond 8500 if we correct, we may need to evaluate a possibility of bear market all together.

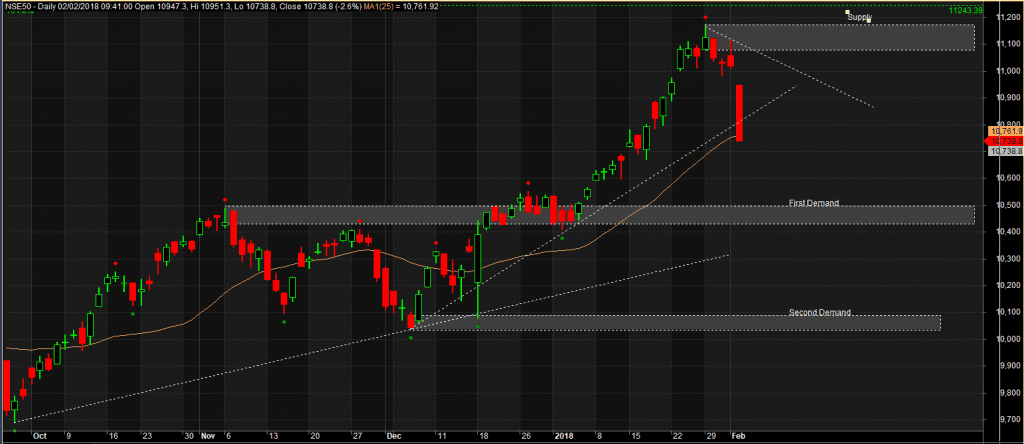

Nifty Daily

Here we draw supply demand lines. And first demand zone starts at 10,500. and second starts at 10,100. With this in mind a correction till 10,500 should be very much possible. Till the time Nifty does not cross 11,200 and prints whole bar above this level, we are in corrective phase. (Unless new areas get developed on the way.

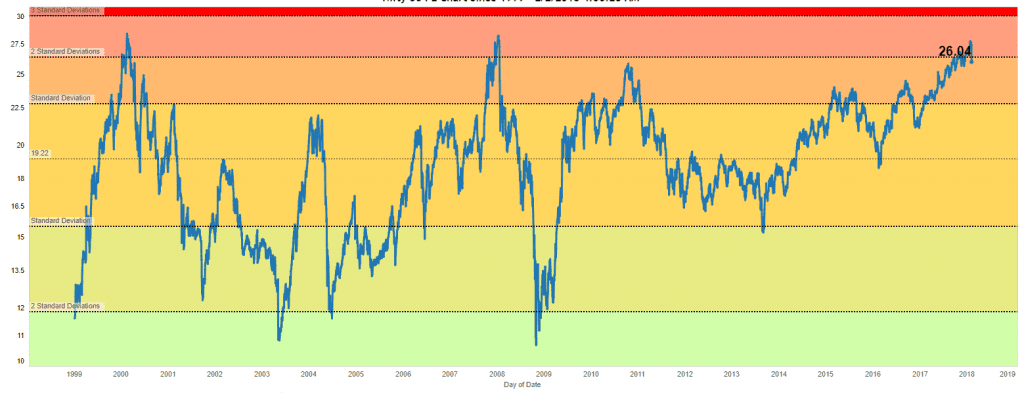

Lets do some PE analysis

Most of the results in Nifty are out now. And we may not see any increase in earnings. If PE wants to come down to a reasonable levels of second deviation (22.8) – Nifty price will need a correction of about 13% (9,400) . and for it to come down to first standard deviation it should correct 26% (8,000). Of course on the way earnings may increase and the nifty levels may also need to be increased.

Options Analysis to find what other traders are doing

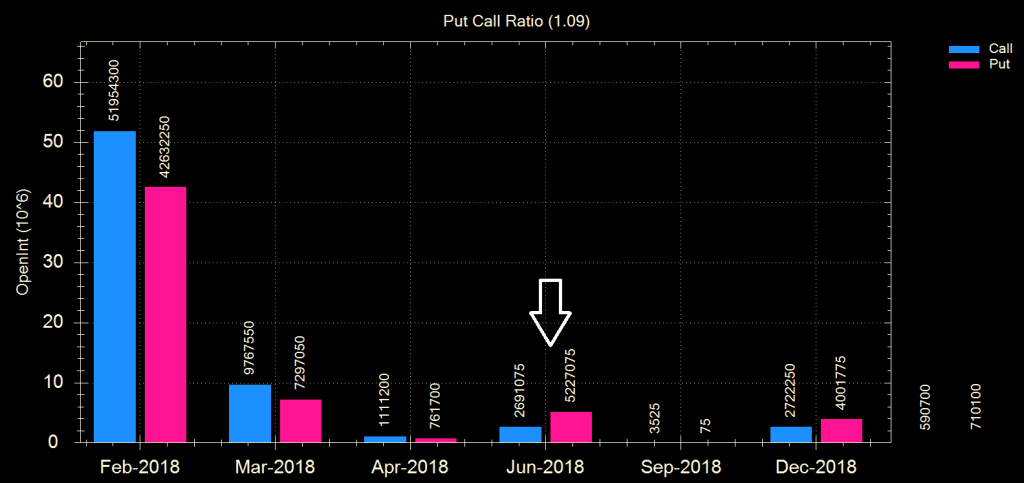

Option writers are usually more sophisticated traders out there as they take unlimited risk for small gains.They are also with large pockets as they need to give large margins. If you are able to read their steps, you can actually guess where and when things may happen to the markets. If you want to answer the question on time, answer can be found (at a high level) looking at Put call ratio (PCR) on monthly level.

In June, I see option traders writing more Puts than calls. And I believe they feel that around that time the markets may reverse the direction.

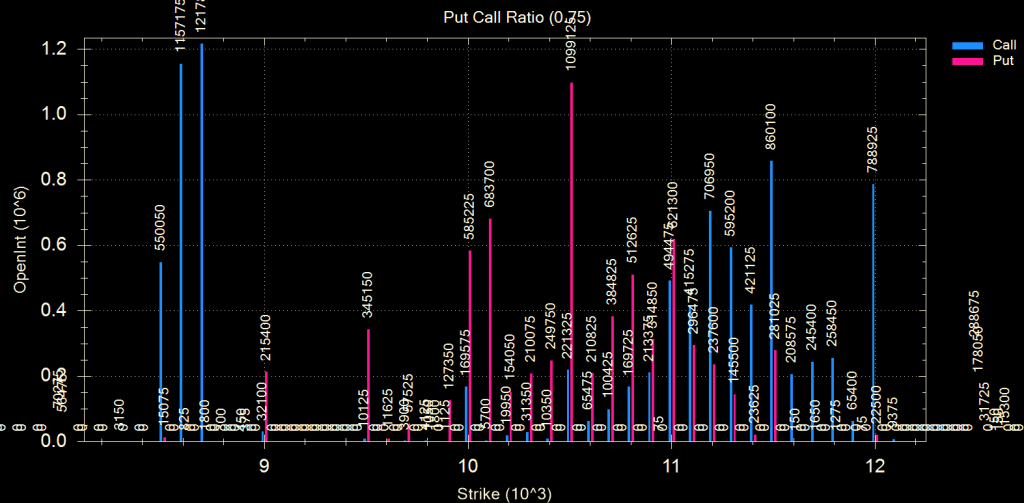

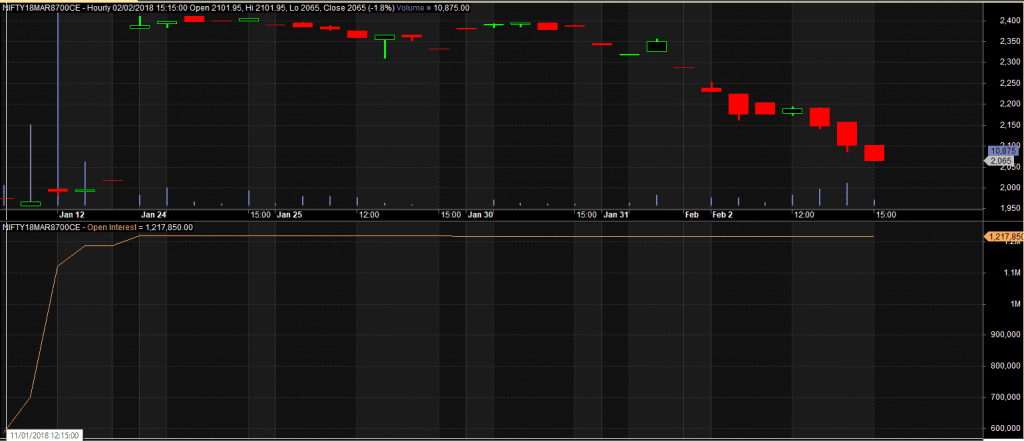

Another very interesting fact is seen in month of March. There is HUGE call writing done at strikes of 8,500, 8,600 and 8,700. This is even higher than OTM strikes… This position size is total 3300 Crore rupees. And premium for these writing is nearly 750 Crores… No retail can have such a risk…

One of my friends mentioned that this may not be option writers but option buyers. Yes, at times its good to buy DITM options rather than using Futures, But for every buyer there has to be a seller. and Seller takes more risks. Secondly, if it was options buyer, he would have exited his position when markets are crashing. Lets find that by looking at detailed options chart.

There is also not a great premium for this option seller. Only motive I believe for him/her is that these are the same players who plan to sell out India stocks in very large numbers themselves and get it to fall to 8,700 or even 8,500 and make this money on the go.

Thanks for reading all the way down!!!! Here are final numbers with my plan.

based on all the above analysis, I expect Nifty to take a pause around 10,500 or 10,100 level. It may go even up from here. That would be very good point to take fresh shorts for a Target of around 8700 sometime in March. This could be done by buying cheap puts of 9,500 or 9,000 around. And then expect a recovery in month of June. That time would be good time for investors to deploy their capital back.

Last words – If you have been benefited and are able to take out your capital in time with inputs from my blog, request you to write your success stories in comments below.

Thanks for the write up, good and timely insight. I am holding few good stocks where my entry was at very low levels. Sold of other stocks low in qty but in green.

Hi Balvinder,

Thanks for the confidence… My sole purpose is to create wealth for people like you… I am a winner when people like you mention such good remark!!!

Cheers

Interesting Analysis Milind, i think earnings are picking up, seems 3 off 4 companies results declared until now have seen earnings upgrade….hence guess correction may not be deep. Howevet joker in pack is Global markets and interest rate cycle reversal. US and also Indian yields have seen sharp rise…..do keep us posted on your valued thoughts…thanka

Hi Vikas,

Thanks for good words…

I guess the stage now is getting prepared for a crash… Writing next in line in some time…